Go long producers, short consumers, says Bank of America

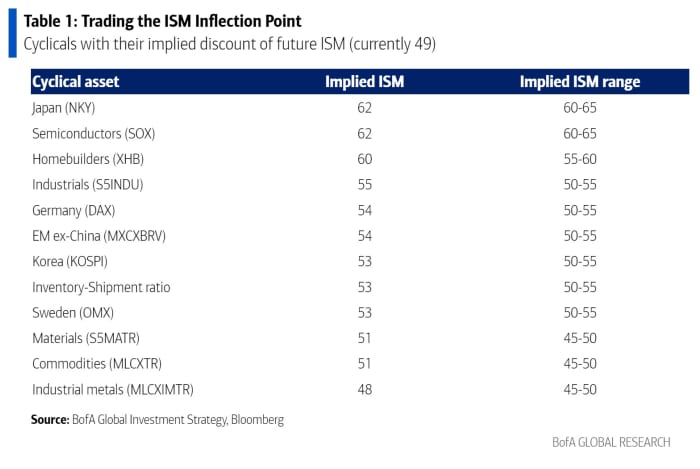

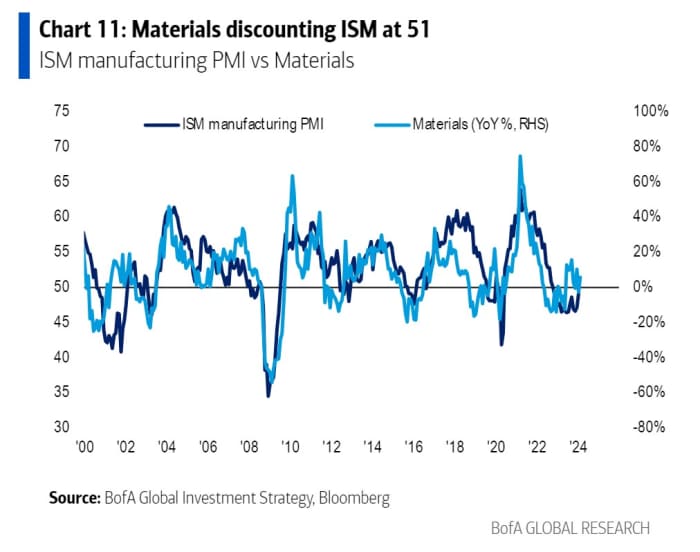

One way to measure how well, or poorly, an asset is doing is to compare it to its historic relationship to an economic variable.

That’s what strategists at Bank of America led by Michael Hartnett did, looking at the U.S. ISM manufacturing gauge, and its typical association with price growth.

The cheapest assets by that measure would be companies in the commodities sector and what the Bank of America team calls “mercantilist stock indices” — referring to South Korea’s Kospi

KR:180721,

Sweden’s OMX

XX:OMXS30,

Germany’s DAX

DX:DAX

and emerging markets outside of China.

On the flip side, Japanese stocks and semiconductor stocks

SOX

are trading as if the U.S. ISM is strong already.

The most recent U.S. ISM manufacturing reading was 49.1%, a level ISM says is consistent with 1.9% annualized GDP growth.

The Bank of America team advise investors to, in their words, be “long producer, short consumer.” The global PMI data tentatively indicate that orders are now outstripping inventories, while consumer tailwinds of excess savings are being extinguished, delinquencies are rising and hiring is slowing, they say.

Source link