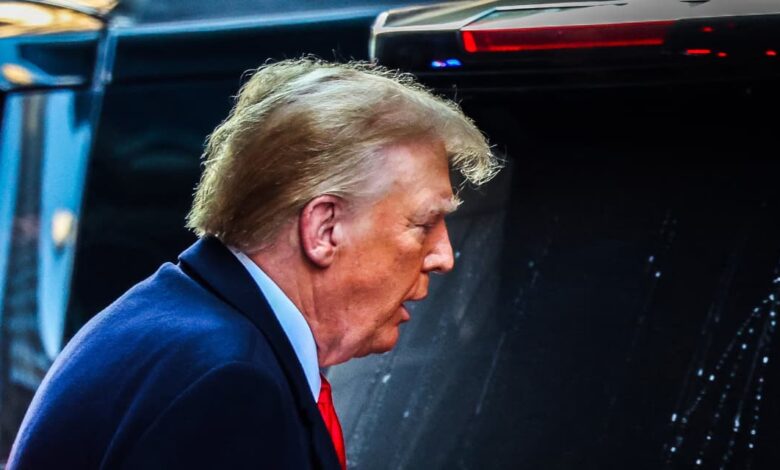

Trump backed further into a financial corner after losing control of his company

With Donald Trump’s legal liabilities growing and a presidential campaign to run, losing control of his company couldn’t have come at a worse time.

After a New York judge ordered the Trump Organization to pay $364 million in penalties and barred the former president from any role in running a business in New York state for three years, Trump now finds himself backed further into a financial corner with fewer options for how to maneuver.

“It will have such an enormous impact on the operation of his business,” said Randy Zelin, a professor of law at Cornell University and a veteran criminal defense attorney with experience in complex financial matters. “But it will also provide a strong basis for an appeal.”

New York Attorney General Letitia James had asked New York State Supreme Court Justice Arthur Engoron to levy a $370 million financial penalty against the Trump Organization and also to ban Trump and his children Ivanka, Donald Jr. and Eric Trump from running any company in the state of New York, where his real-estate empire has long been based.

Engoron’s ruling barred Donald Trump Jr. and Eric Trump from being involved in running any business in the state for two years. The judge also ordered that former U.S. District Court Judge Barbara Jones, who has been serving as an independent monitor of the Trump Organization since 2022, continue in that role with expanded powers for the next three years. The ruling also ordered that an independent compliance officer be appointed within 30 days.

“The Trump Organization shall be required to obtain prior approval — not, as things are now, subsequent review — from Judge Jones before submitting any financial disclosure to a third party, so that such disclosure may be reviewed beforehand for material misrepresentations,” the ruling read.

The ruling also barred the Trump Organization from applying for any loans from a financial institution in New York for three years.

In a statement, Trump called the ruling “a Complete and Total SHAM” and suggested he would appeal.

“The Justice System in New York State, and America as a whole, is under assault by partisan, deluded, biased Judges and Prosecutors. Racist, Corrupt A.G. Tish James has been obsessed with “Getting Trump” for years, and used Crooked New York State Judge Engoron to get an illegal, unAmerican judgment against me, my family, and my tremendous business,” the statement read.

James said in a statement that the decision represented ”a tremendous victory for this state, this nation, and for everyone who believes that we all must play by the same rules — even former presidents.”

“Now, Donald Trump is finally facing accountability for his lying, cheating, and staggering fraud. Because no matter how big, rich, or powerful you think you are, no one is above the law,” her statement read.

The outcome of the civil trial sat solely in Engoron’s hands, and in September, he issued a summary judgment essentially ruling in favor of James’s arguments that the Trump Organization had engaged in fraud for years by repeatedly misstating the value of assets to lenders and insurance companies.

The judgment is the latest in a string of legal and financial blows that the former president has faced and that have already had an impact on his presidential campaign.

Trump has incurred $76 million in legal costs over the past two years stemming from the wide array of criminal and civil prosecutions he faces. More than $27 million of the money raised in the last six months of 2023 to support his presidential campaign has instead been used to cover his legal costs, according to campaign-finance filings.

A report by Bloomberg earlier this week suggested that Trump may face a cash crunch caused by his ballooning legal costs as early as this summer, just as the presidential race will be heating up.

Last month, a federal jury ordered Trump to pay $83.3 million in damages for defaming the writer E. Jean Carroll, whom he had attacked online after she had accused him of raping her in a department-store dressing room in the 1990s. He had earlier been hit with a $5 million verdict in a state case on similar charges.

Trump has vowed to appeal the verdicts and denied raping Carroll, but in order to appeal, he will be required to put up bonds for the full award amounts. That means he would need to either get a bank to back him or to pledge collateral — like a real estate asset — to secure the bond.

But without full control of his real-estate empire, Trump will likely find it harder to line up financing or use his assets as freely as before.

Under the terms of Engoron’s ruling, Trump will no longer be able to make any moves involving assets held by the Trump Organization without the approval of the court-appointed monitor.

Even pledging his assets as collateral for the bond that he would be required to post in order to file an appeal would be complicated by the imposition of a monitor.

“When you lose control of your company, you lose control of who is going to be paid and how much they will be paid. All the money will, first and foremost, be used to operate the business, and how much goes to Trump and his children becomes a secondary concern,” Zelin said.

Add to that the mounting legal costs for multiple criminal cases being brought against him — on charges related to Jan. 6 as well as charges of mishandling classified documents, election fraud, racketeering and illegally paying hush money to women who claimed they’d had affairs with him — and Trump finds himself in a worsening financial bind.

So far, the former president has managed to cover many of his legal costs through donations from his political supporters, but that means that money won’t be available to fund his campaign for president. At the end of the year, President Joe Biden’s re-election campaign had about $46 million cash on hand, while Trump’s campaign had $33 million, Federal Election Commission filings show. Some $50 million held by Trump’s political action committees has already been used to cover his legal bills.

Regarding the properties held by the Trump Organization, while Trump has been able to refinance many of the loans underlying his bigger real-estate holdings, pushing their maturity dates back several years, he still has a stake in some high-profile buildings that have debt coming due in the next few years.

With the court-appointed monitor part of the equation, it might now be more difficult for Trump to secure new debt in order to refinance those buildings, and that could even technically trigger defaults, depending on how the loan covenants were written.

Source link