TSMC Capex Outlook Key to Next Phase of $340 Billion Stock Rally

(Bloomberg) — With Taiwan Semiconductor Manufacturing Co. still trading at pedestrian valuations even after surging to a record high, there is potential for its upcoming results to drive the stock even higher.

Most Read from Bloomberg

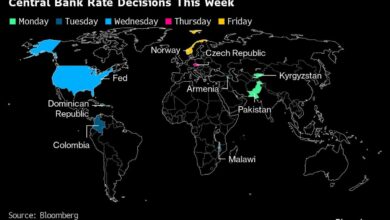

Some market observers see a possibility that the world’s largest chip foundry will raise its revenue and capital expenditure forecasts for the year following its better-than-expected sales for the latest quarter. This would provide evidence that the strong growth fueled by artificial intelligence will be sustained.

As the key maker of chips designed by Nvidia Corp. and others, TSMC is seen as a prime beneficiary of the AI boom. While the current outlook for smartphones and other consumer products remains cloudy, the industry’s continual upgrades to ever-finer circuitry are another positive.

“The top thing to watch is the capex expectations, given that tends to be an indication of the demand they are seeing,” said Xin-Yao Ng, director of investment at abrdn. “We still think TSMC is worth buying because the share price gains are backed by fundamentals, where their dominance and technological leadership in the most advanced chip nodes leave them very well placed to compound earnings at high rates for longer.”

Read More: TSMC’s Sales Surge Most Since 2022 After Riding AI Chip Boom

TSMC’s shares have more than doubled from an October 2022 low, adding $340 billion to the market capitalization of Asia’s largest stock. Yet it’s trading slightly near its five-year median valuation at less than 17 times expected earnings for next year. That compares with more than 28 times for the Philadelphia Semiconductor Index, a 15-year high.

The Taiwanese chipmaker will provide its full first-quarter results on Thursday, shedding light on the sales contributions of various businesses and how profitability has held up as it spends on overseas expansion. Analysts estimate TSMC’s gross profit margin held at 53%, the same level as the previous quarter.

Geopolitical Risks

TSMC is currently budgeting capex of $28 billion to $32 billion for the full year and expects its revenue to grow at least 20%, reversing 2023’s slight decline. The consensus analyst estimate is for $29 billion. The chipmaker’s Taipei-listed stock rose as much as 2.5% Wednesday ahead of the earnings report.

The company has projects underway to build plants in the US, Japan and Germany as it moves to serve global demand and diversify its geographical footprint amid tensions between China and the West.

“TSMC is undervalued as the firm’s dominant position in cutting-edge chips is sometimes overshadowed by geopolitical risks,” said Phelix Lee, an analyst at Morningstar Inc. These concerns were “partially addressed” by recent news that TSMC is receiving $11.6 billion in grants and loans for factories in Arizona under the US Chips Act, Lee added.

The put-to-call ratio on TSMC’s shares has declined from a March high, suggesting there has been more trading in bullish options contracts than bearish ones, according to Blomberg-compiled data based on open interest. On the sell-side, 34 analysts have buy ratings on the stock with one hold and no sells.

“We expect demand and sales growth to be higher for longer than what is currently priced into the stock,” said Peter Garnry, head of equity strategy at Saxo Bank. “A negative of course is the growing need to derisk its manufacturing base out of Taiwan as it increases its capex needs, lowering free cash flows. However, these new chips manufacturing sites outside Taiwan are needed to keep servicing the high demand.”

Top Tech Stories

-

Amazon.com Inc.’s Prime subscription service hit a new high of 180 million US shoppers in March, an increase of 8% from a year earlier, according to Consumer Intelligence Research Partners, which has tracked Amazon memberships since 2014.

-

Take-Two Interactive Software Inc., the company behind the Grand Theft Auto video games, plans to fire 5% its workforce and drop several projects as part of a cost-savings drive.

-

Business software startup Rippling is in talks to raise new funding at a valuation of between $13 billion and $14 billion, according to people familiar with the discussions.

-

The US Securities and Exchange Commission has blocked third-party messaging apps and texts from employees’ work mobile phones, bringing its own practices closer to the standards it’s enforcing for the industry.

–With assistance from David Marino and Cindy Wang.

(Updates price-related data; adds Wednesday’s share move, ‘Top Tech Stories’ section)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link