Government debt of $26 trillion sends U.S. on dire trajectory

The U.S. is in danger of a fiscal crisis erupting after a ballooning in deficits in recent years, according to Olivier Blanchard, a senior fellow at the Peterson Institute for International Economics.

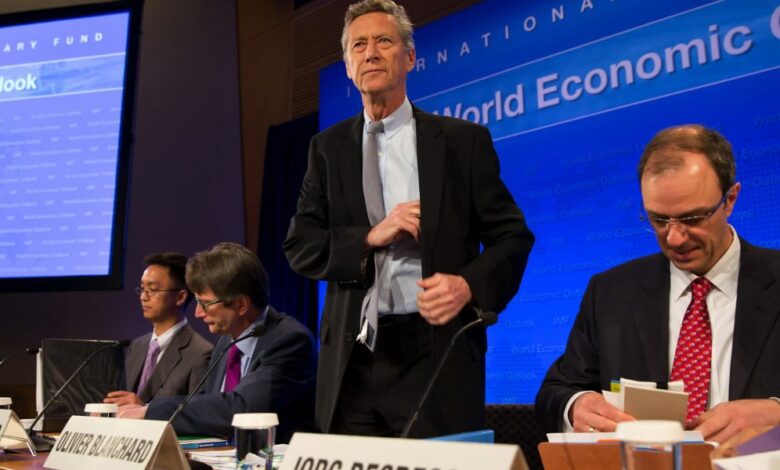

Blanchard, a former International Monetary Fund chief economist who typically has a more relaxed fiscal stance, said he is concerned about the attitude in Washington to eye-watering U.S. government deficits.

“In the U.S., I’m very worried because the primary deficits are very large and there’s absolutely no attempt to decrease them in any way, shape or form,” he told the House of Lords Economic Affairs Committee via video link on Tuesday. Primary deficits exclude government debt costs.

He is the latest to warn of a dire trajectory for U.S. debt after sharp increases in the deficit under President Joe Biden and predecessor Donald Trump.

The huge deficit seen last year has caused concern as it comes after a rise in interest rates and when the economy is growing. US government debt held by the public topped $26 trillion in 2023, or 97% of GDP, according to the Congressional Budget Office. Total government debt is more than 120% of GDP.

Blanchard has famously argued that the fiscal cost of debt is lower as long as interest rates on the debt are below economic growth. Speaking on Tuesday, he said he had a more sanguine attitude toward the risk of debt spirals in other countries, including the UK, where government borrowing is at levels last seen in the 1960s at around 100% of GDP.

“I don’t see a big crisis coming, again except for the US where at some point it will happen, whether it’s in five years, 10 years I do not know,” he said. “As we know, if they struggle in the US, then this has implications for the rest of the world.”

Source link