Is It Too Late to Buy Palantir Stock?

One of the rising stars in the artificial intelligence (AI) arena is Palantir Technologies (NYSE: PLTR). For many years, Palantir sold three data-analytics software suites: Foundry, Gotham, and Apollo.

Last April, Palantir released its fourth flagship product: the Artificial Intelligence Platform (AIP). Its launch has been nothing short of a home run, helping the company quickly expand beyond its previous focus on government contracts.

This newfound growth, coupled with euphoria surrounding AI, caused shares to rise 167% last year. With the stock up another 24% so far in 2024, investors might be thinking they’ve missed out on Palantir.

I see things differently. Let’s break down why Palantir is still a lucrative opportunity for long-term investors.

Don’t call it a comeback

For much of its history, Palantir relied on large, lumpy government deals from the U.S. military and its Western allies before it went public in late 2020. This caused some skeptics to label Palantir more of a consulting operation or government contractor as opposed to a true software-as-a-service (SaaS) business. Moreover, as growth in the government business began to decelerate in 2022, the stock cratered nearly 65%.

With shares reaching an all-time low of just $6 at the end of 2022, things were looking murky for the enterprise software developer. But Palantir demonstrated an impressive level of resiliency last year, essentially reinventing itself amid the AI revolution.

Following the release of AIP last year, the company began hosting immersive seminars called “boot camps” as part of its marketing campaign. The idea was for clients to demo Palantir’s products in real time. By showing prospective customers AIP’s capabilities, management created a large new pipeline of business.

Over the last year, the company has hosted over 850 boot camps, leading to a surge in new customers as AI use cases explode.

In 2023, Palantir’s total customer count increased 35% year over year to 497. But more importantly, customer growth from the private sector rose 44% to 375. In the fourth quarter alone, revenue from U.S. non-government customers increased 70%.

These results silenced the bears and skeptics. Palantir proved it has legitimate AI chops, and customers across a variety of sectors are lining up to try out AIP.

The journey is just getting started

While the customer demand is an encouraging sign, Palantir is growing more than just revenue. Unlike many other high-growth SaaS businesses, it’s consistently profitable. The company has generated positive net income for five consecutive quarters, and adjusted free cash flow rose more than threefold last year.

Another interesting development is its relationship with Oracle, which competes heavily in cloud computing against the likes of Microsoft, Alphabet, and Amazon. Palantir is working to migrate data workloads from its software platforms onto Oracle’s cloud.

I see this as a win-win for both companies. For Palantir in particular, the partnership should serve as a unique source of lead generation for both public- and private-sector business.

A premium valuation well worth it

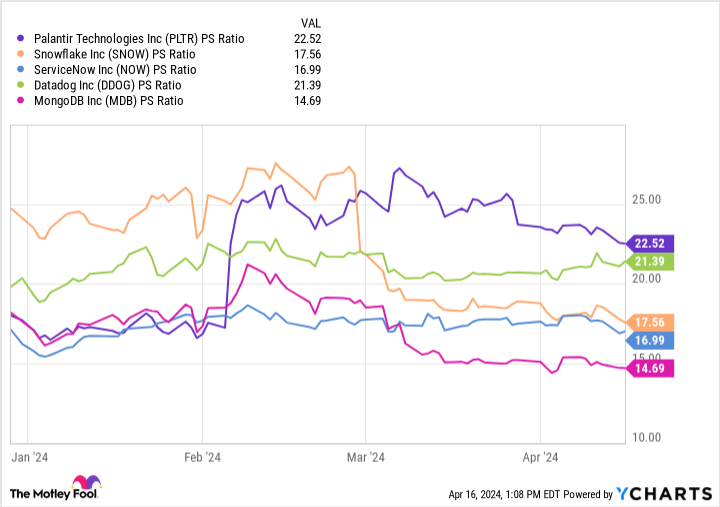

One word of caution for investors is that Palantir stock has gotten a bit pricey. At a price-to-sales (P/S) ratio of 22.5, it’s the most expensive stock among other enterprise SaaS peers such as Snowflake, Datadog, ServiceNow, and MongoDB.

As the chart above illustrates, Palantir’s valuation ballooned in February following the company’s fourth-quarter earnings report.

Zooming out and looking at the bigger picture will help investors as they consider adding Palantir to their portfolio. Despite the surge in share price, the stock is still down more than 40% from its all-time high.

Wedbush Securities analyst Dan Ives recently placed a $35 price target on Palantir stock, implying over 60% upside from current levels.

The more important idea is that investors should remain patient as the AI narrative plays out. They should prepare to hold for the long term and keep an eye out for new developments from Palantir.

The unprecedented demand for AIP coupled with the company’s strong financial position and its strategic relationships makes me think it’s in a good position to emerge as a leader in AI in the long run. The company has proved so far it can fend off big tech, and I don’t see that dynamic changing. Given the recent dip in Palantir stock, now could be the right opportunity to scoop up some shares.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Datadog, Microsoft, MongoDB, Oracle, Palantir Technologies, ServiceNow, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Palantir Stock? was originally published by The Motley Fool

Source link