Dell vs. Super Micro Computer

The market for artificial intelligence (AI) servers has taken off in the past year as cloud companies and data center providers pour money into building their AI infrastructure and developing generative AI applications. This explains why server manufacturers such as Dell Technologies (NYSE: DELL) and Super Micro Computer (NASDAQ: SMCI) have seen their share prices explode.

While Dell’s stock price has nearly tripled in the past year, Supermicro, as it is also known, has shot up a whopping 873%. But what’s surprising is that both companies continue to trade at attractive valuations despite their stunning stock price surges in the past year.

So if you had to buy one of these two AI server plays right now, which one would be a better bet? Let’s find out.

The case for Dell Technologies

Dell Technologies is the leading player in the global server market. The company’s share of the overall server market reportedly stood at 19% at the end of 2022, as per third-party estimates. So it is not surprising to see why the company benefits from the growing demand for AI servers.

In the fourth quarter of fiscal 2024 (ended Feb. 29, 2024), Dell reported that orders for AI-optimized servers increased almost 40% quarter over quarter. The company sold $800 million worth of AI servers last quarter. This figure should continue to move higher, as Dell’s AI server backlog almost doubled quarter over quarter to $2.9 billion. With the AI server market forecasted to clock annual revenue of $150 billion in 2027 compared to $30 billion last year, there is a lot of space for Dell to grow in this market.

It is worth noting that AI servers currently form a small part of Dell’s overall business. The company delivered $22.3 billion in revenue in fiscal Q4, down 11% year over year. The year-over-year decline can be attributed to Dell’s client solutions segment, through which it sells personal computers (PCs) and workstations.

The PC market was not in great health last year, with shipments dropping almost 14% from 2022. This explains why Dell’s client solutions revenue was down 12% year over year in the previous quarter. The good news is that this segment could return to growth in 2024 thanks to the adoption of AI-enabled PCs. Market research firm Canalys expects shipments of AI-enabled PCs to jump from 48 million units this year to 205 million units annually in 2028.

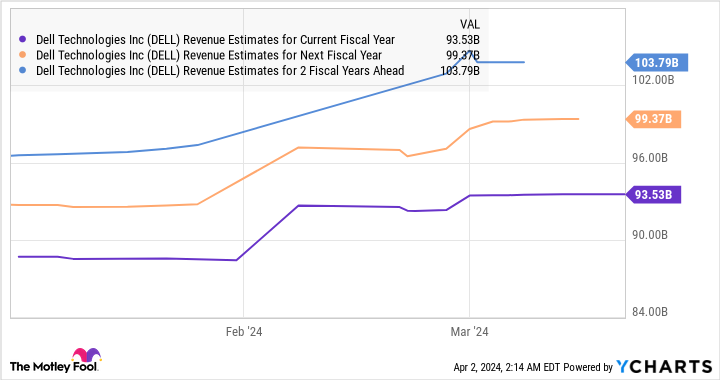

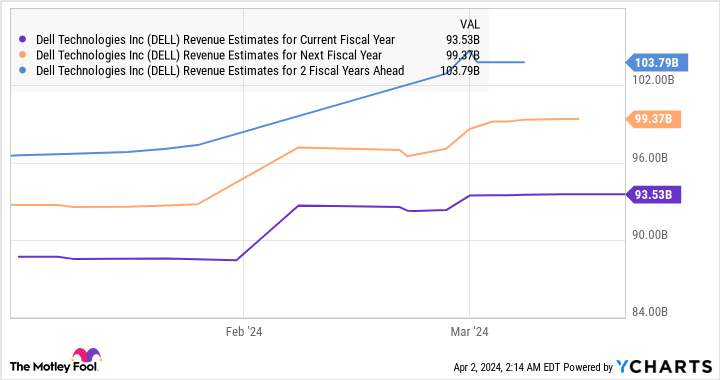

So Dell has two lucrative AI-related catalysts that are likely to help it return to growth from the current fiscal year. The company delivered $88.4 billion in revenue in fiscal 2024, down 14% from the prior year. However, as the following chart shows, its revenue is set to start growing from fiscal 2025.

The case for Super Micro Computer

Super Micro Computer is a much smaller company than Dell. Its revenue in fiscal 2023 (which ended in June last year) was just $7.1 billion. However, being smaller means that sales of AI servers are moving the needle in a bigger way for Supermicro.

The company got more than 50% of its total revenue from selling AI-related server solutions in the previous quarter. This explains why the company’s revenue in the current fiscal year is on track to more than double to $14.5 billion. If half of Supermicro’s fiscal 2024 revenue comes from sales of AI servers, it would generate at least $7.2 billion in sales from this fast-growing market. That translates into a greater quarterly AI server revenue run rate compared to Dell.

It is also worth noting that Supermicro could double its revenue from current levels given that it has expanded its manufacturing operations to support more than $25 billion in annual revenue. The company is witnessing a quick rise in the utilization rates of its current manufacturing capacity. Supermicro management said on the January earnings conference call that “our production utilization rate is about 65% across our USA, Netherlands and Taiwan facilities, and they are quickly filling.”

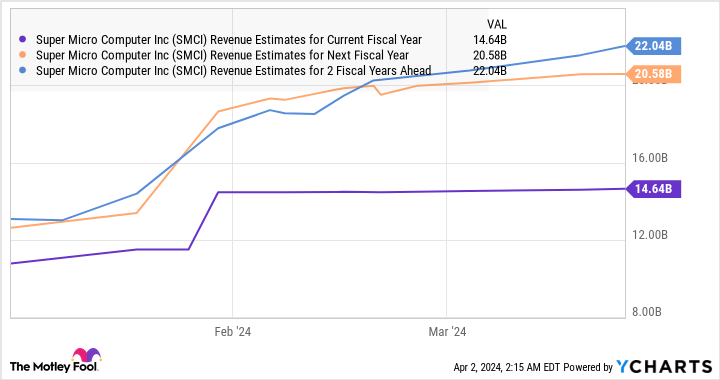

As such, it is not surprising to see why consensus estimates are expecting Supermicro’s top-line growth to remain solid in fiscal 2024 and beyond.

It wouldn’t be surprising to see Supermicro exceeding the fiscal 2026 consensus estimate. That’s because, in management’s words, “next-generation AI and CPU platforms continue to drive strong levels of design wins, orders and backlog from top-tier data centers, emerging cloud service providers, enterprise/channel, and edge/IoT/telco customers.”

The verdict

I have already pointed out that Supermicro’s smaller size is an advantage, as the demand for its AI servers is driving much stronger growth compared to Dell. This explains why analysts forecast Supermicro’s earnings to increase at an annual rate of 48% for the next five years. Dell, meanwhile, is expected to clock nearly negligible annual earnings growth for the next five years.

Of course, Dell’s fortunes could change, and its earnings growth rate could accelerate once its AI server business becomes bigger and AI-enabled PCs start driving growth in the client business. That’s why investors looking for a potential AI winner trading at an attractive valuation might want to consider buying Dell, as it is trading at just 15.7 times forward earnings, lower than Supermicro’s forward earnings multiple of 36.

However, we have seen that Supermicro is growing at a much faster pace, and it can justify its richer valuation as a result. So growth-oriented investors can consider buying Supermicro over Dell, as its fast-growing nature could help deliver healthier gains in the long run.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock: Dell vs. Super Micro Computer was originally published by The Motley Fool

Source link