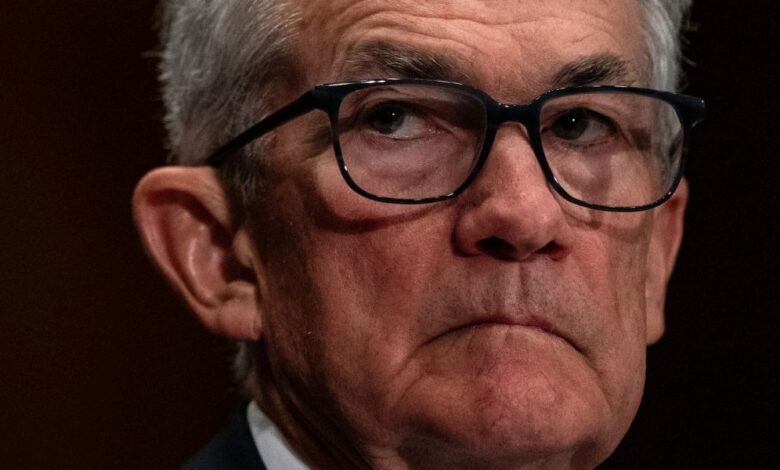

Jerome Powell on commercial real estate: ‘there will be bank failures’

Federal Reserve Chair Jerome Powell joined a chorus of US officials who have argued that mounting bad commercial real estate loans will likely cause some bank failures, but don’t pose a risk to the overall system.

The central bank chief told lawmakers on the Senate Banking Committee on Thursday that the Fed is talking with lenders to make sure they are on top of potential losses. His comments repeated the assessment of Treasury Secretary Janet Yellen, who last month said there will likely be some failures, but the situation will be “manageable.”

“We have identified the banks that have high commercial real estate concentrations, particularly office and retail and other ones that have been affected a lot,” he said. “This is a problem that we’ll be working on for years more, I’m sure. There will be bank failures, but not the big banks.”

Financial regulators have for months been saying that they’re closely monitoring the financial system for fallout from struggling commercial real estate markets.

Potential risks were spotlighted by the recent troubles at New York Community Bancorp, which were fueled by concerns linked to a portfolio including billions of dollars in apartment loans in New York’s rent-regulated complexes. After weeks of tumult, NYCB shares are surging after investors including former US Treasury Secretary Steven Mnuchin invested around $1 billion in the bank.

Separately on Thursday, Martin Gruenberg, who chairs the Federal Deposit Insurance Corp., said that the non-current rate for non-owner occupied CRE loans had risen to the highest since 2014. He said the banking industry remains strong, but that “deterioration in certain loan portfolios, particularly office space and other types of CRE loans, warrants monitoring.”

Source link