Dow Jones Futures: Face-Ripping CrowdStrike Rally To The Rescue? Fed Chief Powell On Tap

Dow Jones futures were little changed overnight, along with S&P 500 futures and Nasdaq futures. CrowdStrike (CRWD) soared overnight, headlining key earnings reports with Fed chief Jerome Powell looming Wednesday morning.

X

The stock market rally suffered sharp losses Tuesday, with the Nasdaq leading the declines. Apple (AAPL) and Tesla (TSLA) continued to slide while software names sold off. Meanwhile, bank stocks continued to do well, while homebuilders held steady.

Bitcoin jumped to a record above $69,000 on Tuesday morning but reversed sharply lower. Crypto-related stocks such as Coinbase (COIN) and Marathon Digital (MARA) also tumbled.

Cybersecurity leader CrowdStrike surged while database software stocks Box (BOX) and Couchbase (BASE) rose on their Tuesday night earnings reports. Oddity Tech (ODD) plunged while Ross Stores (ROST) edged lower.

Retail standout Abercrombie & Fitch (ANF) is due early Wednesday.

CRWD stock is on the IBD 50.

The video embedded in the article discussed Tuesday’s market action and analyzed Duolingo (DUOL), PNC Financial Services (PNC) and Lennar (LEN).

Fed Chief Powell Testifies Wednesday

Fed Chief Jerome Powell testifies before the House Financial Services Committee at 10 a.m. ET Wednesday. He’ll speak before the Senate Banking Committee on Thursday. Powell is expected to reinforce his recent comments and those of fellow policymakers, that there’s no rush to cut rates.

Markets now expect Fed rate cuts to start in June, though those odds have firmed up in the past few days.

The ISM services index on Tuesday fell slightly more than expected in February, but still showed continued growth. On Friday, the ISM manufacturing index unexpectedly fell, continuing to contract.

On Friday, the Labor Department will release the February jobs report.

Dow Jones Futures Today

Dow Jones futures were little changed vs. fair value. S&P 500 futures tilted higher. Nasdaq 100 futures rose 0.2%.

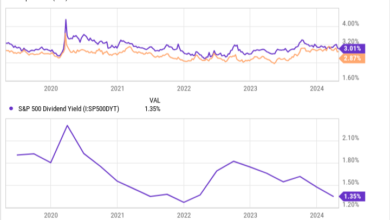

The 10-year Treasury yield edged up to 4.16%.

Bitcoin rose slightly to above $63,500.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Earnings

CrowdStrike earnings beat with the cybersecurity leader offering strong guidance. CRWD stock soared well over than 20% in overnight action. Shares tumbled 5.2% to 297.56 in Tuesday’s regular session, closing above the 50-day line.

Box earnings beat though revenue just fell short. Box stock rose modestly in extended trade after initially soaring. Shares slipped 2.3% to 27.25 on Tuesday, but finding support at the 200-day line after jumping just over 5% Monday.

Couchbase reported a smaller-than-expected loss while revenue topped. BASE stock raced more than 10% higher overnight. Shares retreated 3.9% on Tuesday to 26.87, falling below the 21-day line but still near a two-year high.

Oddity earnings beat but guidance disappointed. ODD stock plunged in extended action. Shares slipped 1.1% to 45.89 on Tuesday. The specialty beauty products firm has a 50.36 consolidation buy point.

Ross Stores earnings beat views with the off-price apparel retailer hiking its dividend and announcing a new buyback. ROST stock declined 1% in overnight trade. Shares edged down 0.5% on Tuesday to 149.17, just blow record highs.

Stock Market Rally

The stock market rally had a tough day, though they major indexes did pare losses shortly before the close.

The Dow Jones Industrial Average fell 1% in Tuesday’s stock market trading. The S&P 500 index retreated 1%. The Nasdaq composite tumbled 1.65%. The small-cap Russell 2000 slumped 1%.

The Nasdaq has given up its strong gains from last Thursday-Friday to record high. While AI chip leaders such as Nvidia (NVDA) are still holding all or the bulk of those gains, other techs have fallen back hard.

Software was a big loser Tuesday, with investors wary ahead of CrowdStrike and following big recent earnings sell-offs in Palo Alto Networks (PANW), Snowflake (SNOW) and GitLab (GTLB).

Meanwhile, Apple stock sank 2.8%, weighing on the major indexes and hitting its worst levels since late October. That came amid fresh evidence of tumbling iPhone sales in China. That news also hit iPhone chipmakers such as Qorvo (QRVO).

Tesla stock slumped 3.9% after Monday’s 7.2% tumble, approaching 2024 lows amid several negative headlines. The relative strength lines for both giants are at 52-week lows, reflecting their underperformance vs. the S&P 500 index.

The Nasdaq, slightly extended again at the end of last week, has fallen from 5.8% above the 50-day moving average to just 3.3%. It tested support at the 21-day line on Tuesday before bouncing slightly. Along with bitcoin reversing lower, some of the speculative froth in the market may be coming off, at least temporarily.

But after big gains or losses in the past week, not many tech plays are in position.

On the plus side, a number of bank stocks, especially superregional banks, have been breaking out or flashing buy signals in the past few days. Homebuilders and many construction-related names are still acting well.

Bitcoin ran to a record $69,208.79 Tuesday morning, but sold off hard, briefly undercutting $60,000 before moving back above $63,000 around 5 p.m. ET. COIN stock hit a two-year high before falling 5.4%. Marathon Digital plunged 13.4% as the upcoming bitcoin halving will slash rewards for bitcoin miners.

The 10-year Treasury yield slumped 8 basis points to 4.14%, below the 200-day moving average for the first time in weeks.

U.S. crude oil prices dipped 0.75% to $78.15 a barrel.

ETFs

Among growth ETFs, the iShares Expanded Tech-Software Sector ETF (IGV) skidded 3.8%, with CRWD stock a notable holding. The VanEck Vectors Semiconductor ETF (SMH) fell 1.5%.

Reflecting more-speculative story stocks, ARK Innovation ETF (ARKK) slumped 3.5% and ARK Genomics ETF (ARKG) gave up 3.2%. Coinbase is the No. 1 holding across Ark Invest’s ETFs. Tesla stock is Cathie Wood’s No. 2 holding.

SPDR S&P Metals & Mining ETF (XME) retreated 1.4% and the Global X U.S. Infrastructure Development ETF (PAVE) declined 0.9%. U.S. Global Jets ETF (JETS) was flat. SPDR S&P Homebuilders ETF (XHB) gave up 1.1%. The Energy Select SPDR ETF (XLE) gained 0.7% and the Health Care Select Sector SPDR Fund (XLV) fell 0.75%.

The Industrial Select Sector SPDR Fund (XLI) dropped 0.8%.

The Financial Select SPDR ETF (XLF) rose a fraction. The SPDR S&P Regional Banking ETF (KRE) jumped 4%.

Time The Market With IBD’s ETF Market Strategy

What To Do Now

The market rally has fallen back, with many software names breaking key levels. A number of recent earnings gaps, including Duolingo and Li Auto (LI), have quickly faltered. That’s after earnings gaps largely worked well in the market rally.

More broadly, there aren’t many stocks to buy, especially in the tech sector. Instead, investors probably should be looking to reduce exposure, at least in technology.

While the Nasdaq and S&P 500 have held support at the 21-day line throughout the market rally, at some point they will not. And even if the market rebounds, your stocks may not. So keep that in mind.

Bank stocks are showing strength. That could be a way to maintain overall exposure while also reducing AI/tech concentration.

Make sure you are running watchlists to spot emerging leaders and sectors.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Catch The Next Big Winning Stock With MarketSurge

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today