The Dow Transports are lagging. Here’s how that impacts stocks and the economy.

As the other major U.S. stock-market averages have soared to new all-time highs, the Dow Jones Transportation Average

DJT

has struggled.

The index as of March 4 was more than 6% below the all-time high it made back in November 2021 — 28 months ago. Over the past year, the Dow Transports has lagged the broader Dow Jones Industrial Average

DJIA

by more than 12 percentage points. The reason this has many investors worried is the belief that the transportation sector is a leading indicator of U.S. economic activity.

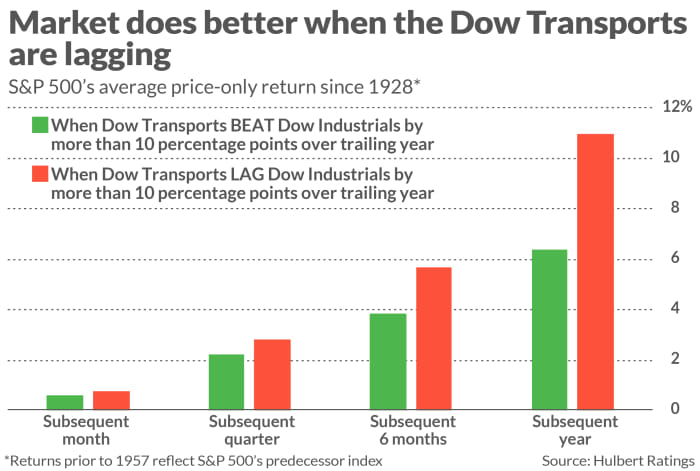

Yet I couldn’t find any data to back this up. On the contrary, there actually is some evidence that the broad market does better in the wake of relative weakness on the part of the Dow Transports.

Consider what I found when analyzing the U.S. stock market’s performance since 1928. For each trading day since then, I calculated the difference in trailing 12-month returns of the Dow Industrials and the Dow Transports. I also calculated, for each day, the returns of the S&P 500

SPX

and its predecessor index (the S&P 500 was introduced in 1957) over the subsequent one-, three-, six- and 12 months. I found that the S&P 500 on average performed better after periods in which the Dow Transports significantly lagged the Dow Industrials — as is now the case.

These differences are plotted in the chart below:

Absolute versus relative weakness

These results show that relative weakness on the part of the Dow Transports is not a grave cause for concern. But what happens when the Dow Transports lose ground, not relative to the DJIA but in absolute terms? That question is also relevant to whether the Dow Transports are a good leading economic indicator.

Once again, however, I found no cause for concern. The S&P 500 performed better, on average, in the wake of 12-month periods in which the Dow Transports fell rather than gained. The difference in 12-month gains is 9.0% versus 6.6%.

The bottom line? There are plenty of legitimate causes of concern these days, from overvaluation to extreme exuberance. There’s no need to compound those worries with concern about the Dow Transports’ weakness.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: U.S. stock investors may be chasing the wrong target

Plus: While tech rally loses stream, this stock-market breadth indicator is at strongest level in years

Source link