Coca-Cola Is About to Do Something It Hasn’t Done in 10 Years

Coca-Cola (NYSE: KO) is one of Warren Buffett’s favorite stocks, and this Dividend King has rewarded shareholders with increasing, high-yielding dividends for more than six decades.

But believe it or not, it’s still in the middle of a recovery after sales fell off a cliff several years ago, and 2024 might signal the culmination of that recovery. Let’s dig in and see how it’s likely to play out, and why it’s important to investors.

Coca-Cola hasn’t always been a beverage superstar

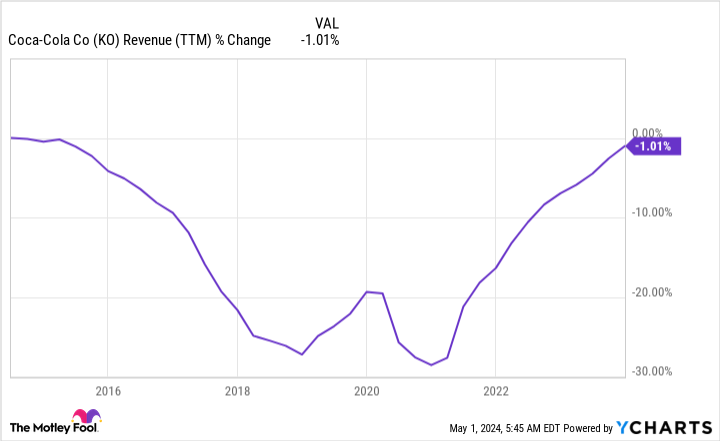

Many people think of Coca-Cola as the prime beverage superstar. It’s the largest beverage company in the world, with $46 billion in trailing-12-month revenue, and sales have steadily increased since bottoming out early in the pandemic; they’re up almost 37% since the worst of that time.

But the problem started well before that. Coca-Cola was becoming too big to control, and it was a disorganized and rigid global operation. Current CEO James Quincey took the reins in 2017, when sales fell a full 15% for the year. He set out a strategy to pull the company together, reorganizing the bottling ventures and creating a fast and agile distribution network.

The pandemic threw a wrench into Coca-Cola’s progress, but it reorganized again, and it’s now working better and faster. However, revenue remains below where it was 10 years ago. It’s getting very close, though, and it’s likely to finally surpass that target in the 2024 second quarter:

Coca-Cola might be better than ever

There’s good reason to believe Coke can continue on its growth trajectory under Quincey’s steady guidance. One of the major moves it made early in the pandemic was slashing its brand portfolio by about half, from 400 to 200 brands. That’s a bold action that freed up resources to devote to its core assets, and Coca-Cola’s eponymous brands continue to be its main attractions. Management said that it owns 26 different brands that each bring in more than $1 billion annually, and these main brands are key to future growth.

It’s not letting it go at that, though. The brands it got rid of were small, mostly local underperformers responsible for about 2% of volume and 1% of revenue. Coca-Cola is still acquiring new brands, but it’s focused on top global brands that have robust opportunities in larger markets. For example, it acquired Bodyarmor in 2021, when the brand was growing sales at a rapid clip. Bodyarmor is now one of the company’s $1 billion brands.

Acquisitions can be an important growth driver because when Coke adds new drinks to its systems, they can reach new customers with great efficiency. That can lead to a big boost in revenue, at least initially, without adding commensurate expenses.

With this twin growth strategy of investing in its core brands and acquiring new ones to boost sales, Coca-Cola is well positioned to use its distribution network effectively and generate higher sales and profits. It’s touching the tip of its previous record sales figures, and it should easily go higher.

Is now the time to buy Coca-Cola stock?

Coca-Cola has been a reliable dividend superstar for decades, but its stock price hasn’t been as impressive, trailing the broader market for most of the past 30 years. That doesn’t make it a loser; on the contrary, most individual stock portfolios benefit from having some stable high-value and dividend stocks that anchor their holdings.

Coca-Cola stock offers stability, value, and reliable passive income. And as it’s poised to set a record for annual sales this year, this is a great time to buy the stock.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Coca-Cola Is About to Do Something It Hasn’t Done in 10 Years was originally published by The Motley Fool

Source link