Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever.

The healthcare industry is a fantastic place to find passive income. Healthcare is recession-proof, and there’s always a need for better technology and new treatments. The industry’s top dogs have been in the game for decades and can generate wealth for patient shareholders who come along for the ride.

Thanks to their market-leading positions and blockbuster drugs, stocks like Novo Nordisk (NYSE: NVO), Eli Lilly (NYSE: LLY), and AbbVie (NYSE: ABBV) are potential dividend goldmines.

Here is what you need to know about these three stocks and their ability to pay dividends for decades to come.

1. Novo Nordisk has revolutionized weight loss

Obesity has long been a problem in the modern world. Novo Nordisk’s history of trying to solve this problem goes back to the beginning of modern diabetes treatment when the company commercialized insulin in the early 1920s. Insulin remains a core business for Novo Nordisk today.

Recently, the company revolutionized healthcare and weight management with its GLP-1 drugs Ozempic and Wegovy. The drugs are designed to mimic the hormones in the body that simulate fullness and diminish appetite. The drugs treat Type 2 diabetes (Ozempic) and chronic weight management (Wegovy).

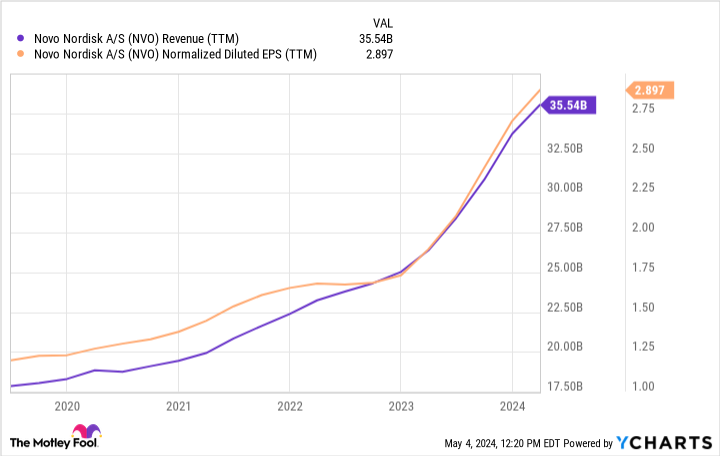

These drugs have been a smashing success and have accelerated Novo Nordisk’s growth to new heights:

That could spell years of aggressive dividend growth for shareholders. Today, the dividend is only about half of earnings, so there is a long runway for dividend growth, considering analysts believe Novo Nordisk’s bottom line will compound at 18% annually over the long term. The overweight/obesity rate in America alone is a staggering 69%. While not everyone will take GLP-1 drugs like Ozempic, it’s a significant enough market opportunity for Novo Nordisk not to have any issues finding new patients for a while.

Novo Nordisk offers a solid starting dividend yield of 1.5% with potential for stellar growth; the dividend has grown by an average of 6.5% annually over the past five years, so investors are getting inflation-beating increases. The company’s rosy growth outlook could mean larger dividend increases over the coming years.

2. Eli Lilly is a diversified giant with similar tailwinds

Pharmaceutical conglomerate Eli Lilly is rebuilding its dividend credentials. The company held its dividend the same for several years after the financial crisis in 2008-2009 and is now up to 10 years of consecutive growth. Eli Lilly is a far more diversified company than Novo Nordisk. The company’s products span Alzheimer’s, immunology, oncology, pain management, weight management, and diabetes. It sells a rival product to Ozempic in Mounjaro, giving Eli Lilly similar upside exposure.

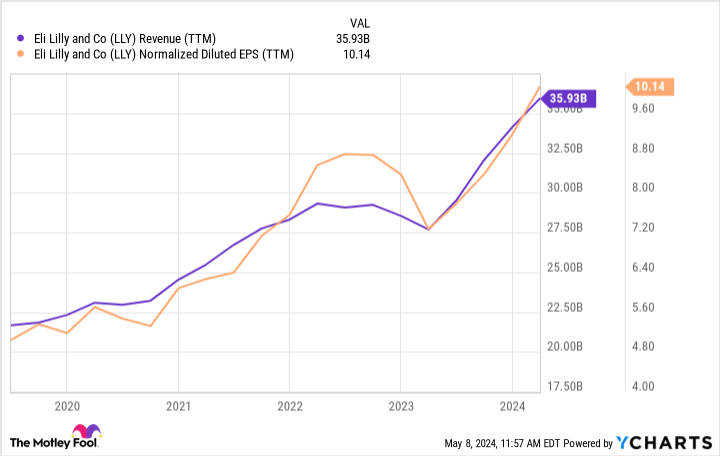

Financially, Eli Lilly is a powerhouse. The company has $36 billion in annual revenue, growing rapidly behind a pipeline and drug lineup firing on all cylinders. Mounjaro was approved in mid-2022, so that’s ramping up and should provide a similar tailwind as Ozempic is for Novo Nordisk moving forward. Analysts believe Eli Lilly’s earnings will compound at a blistering 36% annualized rate over the next three to five years.

That type of earnings growth should spell significant dividend growth for shareholders. Today, the dividend is roughly 68% of earnings. If Eli Lilly performs to expectations, the company could throw investors double-digit annual increases and shrink the dividend payout ratio. That’s a nice spot to be in, which makes Eli Lilly a likely dividend superstar moving forward.

3. AbbVie is following up its best seller with new success

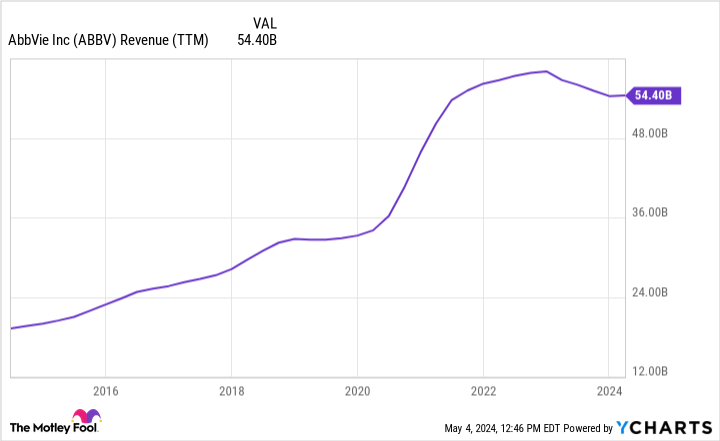

AbbVie once ruled the pharmaceutical world with top seller Humira, an anti-inflammatory drug that recently saw its patent protection expire. That was less than ideal, but AbbVie has shown that it’s far more than a one-trick pony, and the company’s future looks as bright as ever. AbbVie still gets sales from Humira but has begun displacing Humira with two new, similar drugs, Skyrizi and Rinvoq. These two are on a combined run rate of $12 billion in sales this year. Additionally, AbbVie used its Humira profits to acquire Botox maker Allergan for a whopping $63 billion in 2020.

This has meant that sales only slightly dipped when Humira, which used to account for almost half of revenue, lost some of its patent protection. Frankly, that’s a remarkable feat and reflects the quality of the management team leading the company.

Analysts are bullish again on AbbVie’s future, with estimated annualized earnings growth averaging 7% annually over the long term. That may not seem like much, but AbbVie pays a hefty dividend that yields a robust 3.8% at the current share price. Over time, that’s potentially 10% to 11% of total returns, which can quickly build wealth for patient investors. AbbVie’s a Dividend King if you count its days as a subsidiary of Abbott Labs, so this is a proven gem with a bright future ahead.

Should you invest $1,000 in Novo Nordisk right now?

Before you buy stock in Novo Nordisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novo Nordisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever. was originally published by The Motley Fool

Source link