Inflation-hit consumers find help in SPAM says Hormel Foods CEO

Forget cereal for dinner, SPAM is here to save the day for customers looking to save cash in an inflation-hit economy.

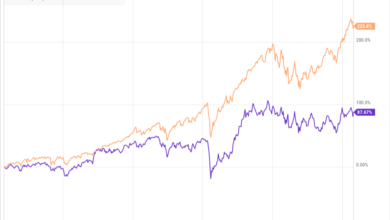

The CEO of Hormel Foods, the owner of the tinned meat brand, was optimistic about the future having posted strong Q1 2024 earnings results which sent share prices spiking 15%.

Jim Snee, who also acts as Hormel’s president and chairman, later told CNBC he expects strong results in the coming year courtesy of the business’s “protein portfolio” spanning meat-free alternatives and affordable options.

And in an economy where consumers are facing down ‘shrinkflation’ and spiraling food costs, this affordable option may prove all the more important.

“The SPAM brand continues to resonate with consumers,” Snee told Jim Cramer in an interview Thursday. “[SPAM] is a great, affordable source of protein that is meeting all of the consumer’s needs.”

SPAM, which became something of a delicacy during the Second World War and currently retails for around $3.50, was noted multiple times during Hornel’s earnings call this week as an area with strong consumer loyalty and space for growth in the coming months.

On the call Snee noted consumer analysts Circana had highlighted “several positives for the quarter as we gained or maintained share across many of our products in key categories, including the SPAM family of products.”

He added: “We expect net sales increases in our International business to be driven by the branded export business led by refrigerated items, Skippy and SPAM and the retail and foodservice channels in China.”

Rising food prices

Snee, who joined the business in 1989, isn’t the only food boss pushing his product as a lower-cost alternative for families looking to tighten the purse strings. Food is getting more expensive month-to-month, and is expected to tick higher.

The CPI for all food items increased 0.6% from December 2023 to January 2024 and was 1.2% higher than January last year. Restaurant prices are up 5.1% compared to the same time last year.

These figures have prompted the likes of Kellogg’s CEO, Gary Pilnick, to suggest that families struggling financially should turn to the likes of cornflakes for dinner. He told CNBC: “Consumers are under pressure… so we’re advertising about cereal for dinner, if you think about the cost of cereal for a family versus what they might otherwise do, that’s going to be much more affordable…

“In general, the cereal category is a place that a lot of folks might come to, because the price of a bowl of cereal with milk and with fruit is less than a dollar. So you can imagine why a consumer under pressure might find that to be a good place to go.”

PepsiCo is also asking consumers to get creative with their carbs. At an industry conference in Florida last week, CEO Ramon Laguarta said he hoped consumers would use salty snacks, such as Doritos and Rold Gold pretzels, as “side dishes and ingredients” in meals, extending their purpose beyond a midday or late-night munchie.

The Ozempic effect

Where Pilnick was blasted on social media for being out of touch with reality, Snee positioned Hormel Food’s range as being a central component of a wider, healthy diet.

With this in mind the New Mexico State University alumni said he’s similarly not losing sleep over increasing public interest in weight-loss drugs like Ozempic. Lars Fruergaard Jørgensen, CEO of the creator of the appetite suppressant Novo Nordisk, has even said panicked food retail bosses have called him seeking assurances about the company’s plans to rollout the product.

“A couple of CEOs from, say, food companies have been calling me,” Jørgensen told Bloomberg. “They are scared about it.”

Although Jørgensen didn’t name any individuals executives at some businesses have been open about a potential shift in customer behavior. Walmart’s U.S. boss, John Furner, said in October that the company was already beginning to see a material impact on its sales thanks to its Ozempic-using customers.

“We definitely do see a slight change compared to the total population; we do see a slight pullback in overall basket,” Furner said. “Just less units, slightly less calories.”

By contrast, Snee said Hormel’s offering could answer to medical concerns over frailty in those eating smaller amounts of food: “We are so well positioned with this protein portfolio … one of the things we are very intentional about is balance. We think about affordable protein, we think about indulgent protein, we think about natural and organic protein, we’ve got meat and non-meat protein.

“No matter how you think about our portfolio you’re going to encounter protein which is a really important part of any diet program, especially with these new weight-loss drugs that are all the rage.”

Source link