Is This Small Chip Stock Better Than AMD and Intel?

Over the last decade, various players in the semiconductor industry have been getting acquired in bids to consolidate the market. One specific type of chip drew significant attention: field programmable gate arrays, or FPGAs — a chip type with growing relevance because it’s used in the semiconductor design process, artificial intelligence (AI) system designs in data centers, and in industrial and consumer electronics.

Software also features prominently in FPGAs, since it is used to program (or customize) those chips for the specific uses customers require.

In 2015, Intel (NASDAQ: INTC) acquired Altera, a major FPGA player, for nearly $17 billion. And in 2022, AMD (NASDAQ: AMD) purchased FPGA pioneer and leader Xilinx for nearly $50 billion in an all-stock deal that completely transformed its business.

Those two mega-mergers effectively left just one FPGA pure-play company standing: Lattice Semiconductor (NASDAQ: LSCC). Lattice is going through some struggles right now, but its shares have outperformed Intel in grand fashion over the last five years. And up until AMD’s most recent AI-fueled surge, Lattice was outperforming it, too. There’s one key reason it could be a far better long-term investment right now.

Lattice is in a cyclical downturn, but for how long?

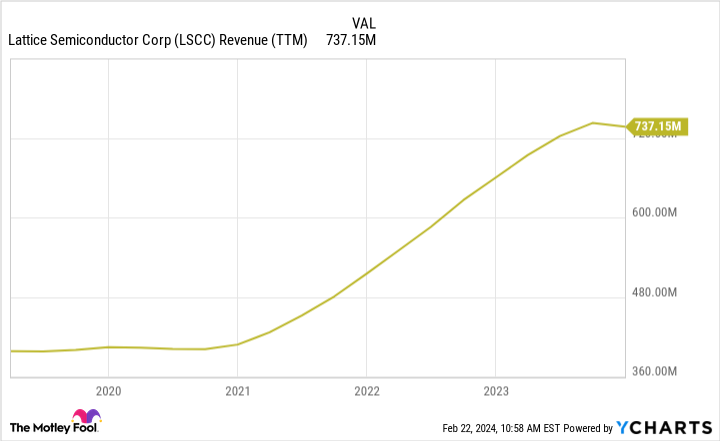

Lattice had a really strong few years, especially after CEO James Anderson (formerly an executive at AMD) came aboard and started implementing strategies aimed at new product introductions. Data centers, industrial automation, and the digitalization of cars in the wake of the pandemic helped fuel its growth.

But downturns have come for some of these end markets, and Lattice is being hit, along with peers that also sell ample numbers of chips to industrial and automotive customers.

The problem? After several years of chip shortages, slowing industrial demand has led to a period of chip oversupply. Lattice is now undersupplying FPGAs to help customers work through excess inventory. Some of these customers have delayed implementing a few of the company’s newest chip designs and accompanying software for the time being as well.

The end result is that the company is experiencing a cyclical downturn in revenue for the first time in quite a while. On its Q4 earnings call this month, Anderson and his team talked at length about why the first quarter of 2024 is going to be ugly. Revenue is expected to be down as much as 30% from the year prior to a range of $130 million to $150 million, but Lattice does expect its business conditions to improve in the second half of 2024 as customer inventory levels normalize.

While that big unwinding of its recent revenue advances is unsettling, Lattice’s upbeat commentary about the second half of 2024 at least jibes with what other industrial chipmakers and hardware designers have been saying.

Lattice has one key advantage

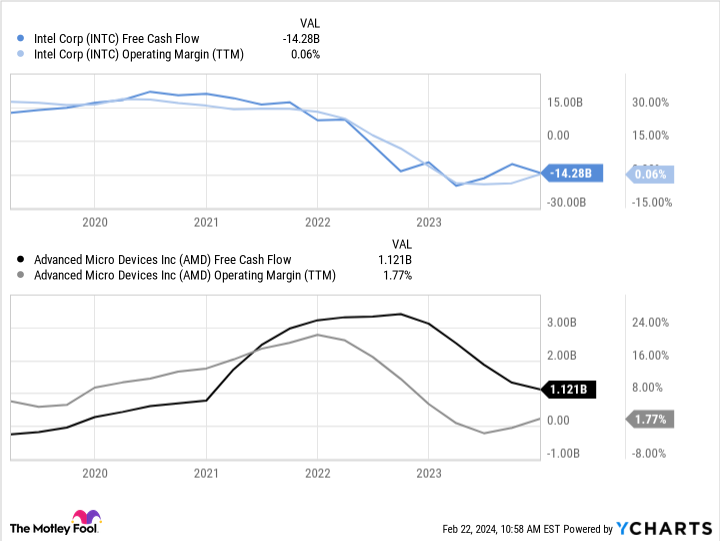

Its financials are poised to get worse before they get better, but Lattice holds a key advantage as it deals with its downturn that not even AMD and Intel have: durable profitability.

Anderson and company think Lattice will remain highly profitable in the coming quarters. Even at the bottom end of its first-quarter guidance range, the company forecasts adjusted operating profit margins of at least 26%.

That’s rock-solid for a sizable cyclical downturn. When AMD and Intel were in the throes of their cyclical downturns of the last year and a half, their profitability all but dried up.

Of course, the chipmaker will need to prove it. There’s always a chance that this cyclical downturn will get worse and last longer than expected. But at the onset of the coming decline, small and nimble Lattice looks like a best-in-class provider of FPGAs, at least from a business model standpoint.

Shares of this small chip designer and software provider do trade for a premium of about 40 times trailing-12-month earnings per share and trailing-12-month free cash flow. But if it can continue to outperform its much larger peers and return to highly profitable sales growth later this year, its stock might be worthy of consideration alongside some of the top names in the semiconductor industry.

Should you invest $1,000 in Lattice Semiconductor right now?

Before you buy stock in Lattice Semiconductor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lattice Semiconductor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Nick Rossolillo and his clients have positions in Advanced Micro Devices and Lattice Semiconductor. The Motley Fool has positions in and recommends Advanced Micro Devices. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Is This Small Chip Stock Better Than AMD and Intel? was originally published by The Motley Fool

Source link