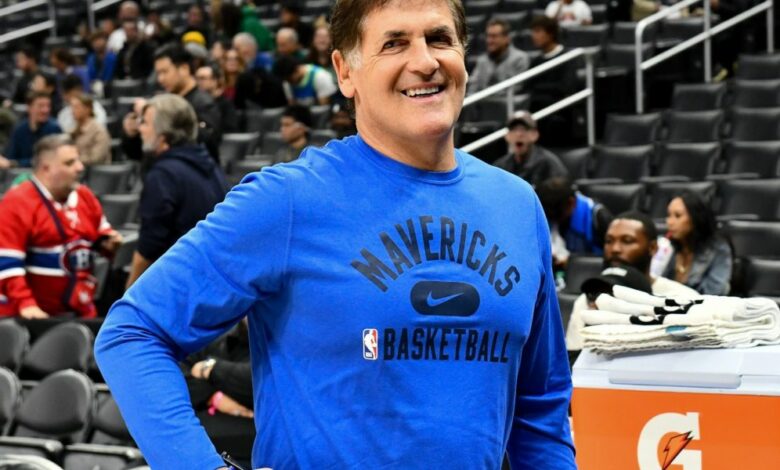

Billionaire Mark Cuban says ‘we’re not in a tech bubble’

The recent rise of generative AI and the subsequent tech-stock surge have some veteran investors concerned that we’re replaying the late ‘90s dot-com bubble, when hype over the internet era led to a serious boom-and-bust cycle for stocks. But billionaire entrepreneur Mark Cuban, who made a big chunk of his $7 billion fortune while the dot-com bubble was inflating, said he doesn’t see the resemblance to that precarious period.

“We are not in a tech bubble, and as far as similarities [to the dot-com era] go….none at all,” he told Fortune via email.

Cuban—who is perhaps best known as the Dallas Mavericks former majority and current minority owner—has certainly proved he has a good read on the frothiness of markets and the tech world over the years. As Fortune’s Devin Leonard detailed in a 2007 article, Cuban sold two companies during the 1990s, and his timing was excellent on both occasions.

At the start of that decade, at just 32, Cuban became a multi-millionaire after selling his company MicroSolutions, which sold and installed both hardware and software, to CompuServe for $6 million. The sale came just before computer prices plummeted in 1991 due to a price war in the industry.

Five years later, Cuban and his partner Todd Wagner launched an internet-radio company that planned to broadcast sports games, called Audionet. The company later became an internet-era darling when it added streaming video and took on the name Broadcast.com. Wagner told Fortune in 2007 how he and Cuban leveraged the rapid technological progress and hype of the internet era into a big deal with the then-dominant tech giant Yahoo. “We went to Yahoo and AOL, which we both knew very well, and said, ‘Either you buy us or you are going to play catch-up,’” he said.

Their ploy worked, and Broadcast.com was eventually sold to Yahoo for $5.7 billion in 1999—just before the dot-com crash the following year. But the thing is, in 2024, Cuban said he doesn’t see the same bubble-like developments that were so prevalent during the dot-com era today.

The stock market is missing key bubble features

Despite being weighed down by rising interest rates and stubborn inflation, the S&P 500 has surged 27% over the past 12 months to a record high of over 5,000. And with Wall Street labeling the rollout of generative AI applications like OpenAI’s ChatGPT a modern-day “gold rush” for investors, the tech-heavy Nasdaq Composite, which is normally more sensitive to higher rates, has surged 38%.

But Cuban—who just released a MasterClass detailing some of his top tips for entrepreneurs in the AI era—said that despite the recent rise in stock prices, he’s not seeing many dot-com era features, noting that “we’re not seeing ridiculous companies go public or raise money.”

To his point, the venture-capital industry, which usually manages explosive growth during market bubbles, has been quiet over the past year. As Fortune’s Jessica Matthews reported, nearly 600 “unicorns”—private firm’s with a valuation of over $1 billion—were minted in 2021 when interest rates were low and tech stocks were surging. But in 2023, despite the AI hype, just 71 companies earned unicorn status.

The IPO market, which also typically booms during stock-market bubbles, has fizzled over the past year as well. After a record-breaking 397 companies went public in 2021, just 153 businesses listed their shares last year, according to EY.

A number of Wall Street analysts have also pushed back on the dot-com bubble narrative. In a Friday note, Wedbush tech analyst Dan Ives argued the current market isn’t giving out “sky-high” valuations to companies with weak balance sheets and questionable business models. Instead, the winners of the AI era have been companies like the semiconductor giant Nvidia, which have proven their ability to turn a more-than-healthy profit. “As someone that covered tech stocks during the Dot.com bubble/burst this is nowhere near the 1999/2000 period in our view,” Ives wrote.

Still, questions linger about the dominance of the tech sector—and even the optimistic valuations of big tech giants—and that does harken back to the dot-com era.

Market concentration is still a concern

In 1999, surging tech valuations based on hype surrounding the internet led the tech sector to make up a record 33% of the S&P 500. Similarly, the tech sector accounts for around 29% of the S&P 500 today, according to U.S. Bank Wealth Management.

But the market concentration of the AI era goes further than just the tech sector. With big tech giants like Nvidia, Microsoft, and Google benefitting from the generative-AI hype, the top 10 largest companies in the U.S. have begun to dominate the market, accounting for more than 30% of the S&P 500. These giant companies also contributed roughly 70% of the index’s gains in 2023.

This concentration in the tech sector, and particularly big tech, could be a serious market risk this year, according to Maxime Darmet, a senior U.S. economist at Allianz Trade, who warned in a February 8 note that it “highlights a dependency on a few companies.”

JPMorgan quantitative strategists even warned at the end of January that the dominance of the top 10 stocks in the U.S. market is becoming reminiscent of the dot-com bubble, when these companies made up a record 33.2% of the MSCI USA Index, which tracks 609 large- and mid- cap U.S. companies.

“The key takeaway is that extremely concentrated markets present a clear and present risk to equity markets in 2024,” they wrote in a note to clients, per Bloomberg. “Just as a very limited number of stocks were responsible for the majority of gains in the MSCI USA, drawdowns in the top 10 could pull equity markets down with them.”

Cuban told Fortune that market concentration is really the only risk he sees after brushing off other comparisons to the dot-com era. “Much of the market wealth is tied up in 7 companies. All of whom compete at some level. So there are risks to those companies that could impact the entire market,” he warned.

Source link