Traders Tread Cautiously in Wake of Iran Attacks: Markets Wrap

(Bloomberg) — Investors are treading cautiously in early Asian trading as markets grapple with ratcheting tensions after Iran’s unprecedented attack on Israel at the weekend.

Most Read from Bloomberg

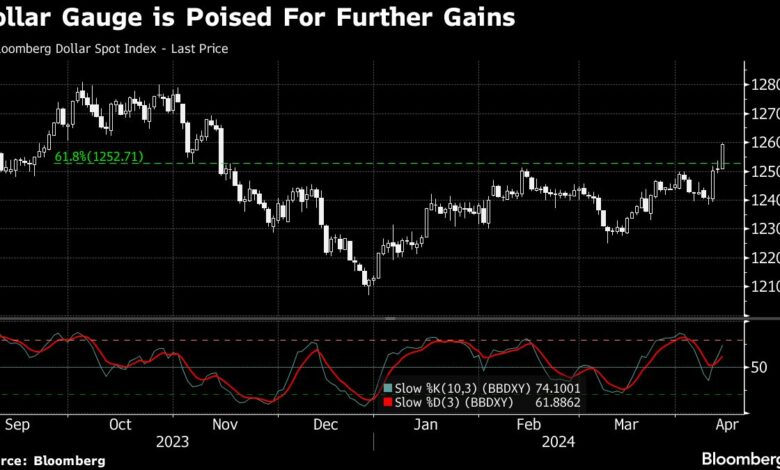

The dollar was steady against its major developed market peers and US stock futures edged higher after the S&P 500 suffered its worst session since January on Friday amid a flight to safety. Oil edged lower and gold rose, while Asian equity futures pointed to early losses. Australian 10-year yields opened lower.

With investors already rattled by sticky inflation and the prospect of higher-for-longer interest rates, the escalation of the Middle East crisis risks injecting fresh volatility into markets. As the conflict widens, many say oil could surpass $100 a barrel and expect a flight to Treasuries, gold and the dollar, along with further stock-market losses.

While Iran said “the matter can be deemed concluded,” traders are now waiting to see if the conflict spirals into a widespread regional war. Still, nerves may be tempered following a report that President Joe Biden told Israeli Prime Minister Benjamin Netanyahu that the US won’t support an Israeli counterattack against Iran.

“For markets this may eventually play out as a fade as Iran and Israel step back from the brink,” said Namik Immelbäck, chief strategist at Skandinaviska Enskilda Banken AB. “But near term this should lead to position reduction from especially trend following quant strategies” which should exacerbate the typical flight to safety, he said.

Read More: Iran’s Attack on Israel Sparks Race to Avert a Full-Blown War

Bitcoin sank almost 9% in the wake of the attacks on Saturday, only to rebound and trade around the $65,000 mark. Stock markets in Saudi Arabia and Qatar posted modest losses under thin trading volumes on Sunday. Israel’s equity benchmark fluctuated between gains and losses at least nine times before closing with a small gain.

Oil will be of close focus as investors look to it as a guide for how to respond given the risk of a strike and counter-strike cycle. Brent crude is already up almost 20% this year and last traded around $90 a barrel.

In the bond market, investors will be weighing the risk that more expensive energy bills may add to swirling inflation fears. While Treasuries tend to benefit in times of uncertainty, the threat of interest rates staying high could limit moves. Treasury futures opened lower.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.3% as of 7:45 a.m. Tokyo time

-

Hang Seng futures fell 1.7%

-

S&P/ASX 200 futures fell 0.6%

-

Nikkei 225 futures fell 1.8%

Currencies

-

The euro was little changed at $1.0648

-

The Japanese yen was little changed at 153.26 per dollar

-

The offshore yuan was little changed at 7.2660 per dollar

-

The Australian dollar was little changed at $0.6471

Cryptocurrencies

-

Bitcoin rose 2.2% to $65,257.71

-

Ether rose 2.6% to $3,148.13

Bonds

Commodities

-

West Texas Intermediate crude fell 0.4% to $85.35 a barrel

-

Spot gold rose 0.7% to $2,360.77 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Michael G. Wilson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link