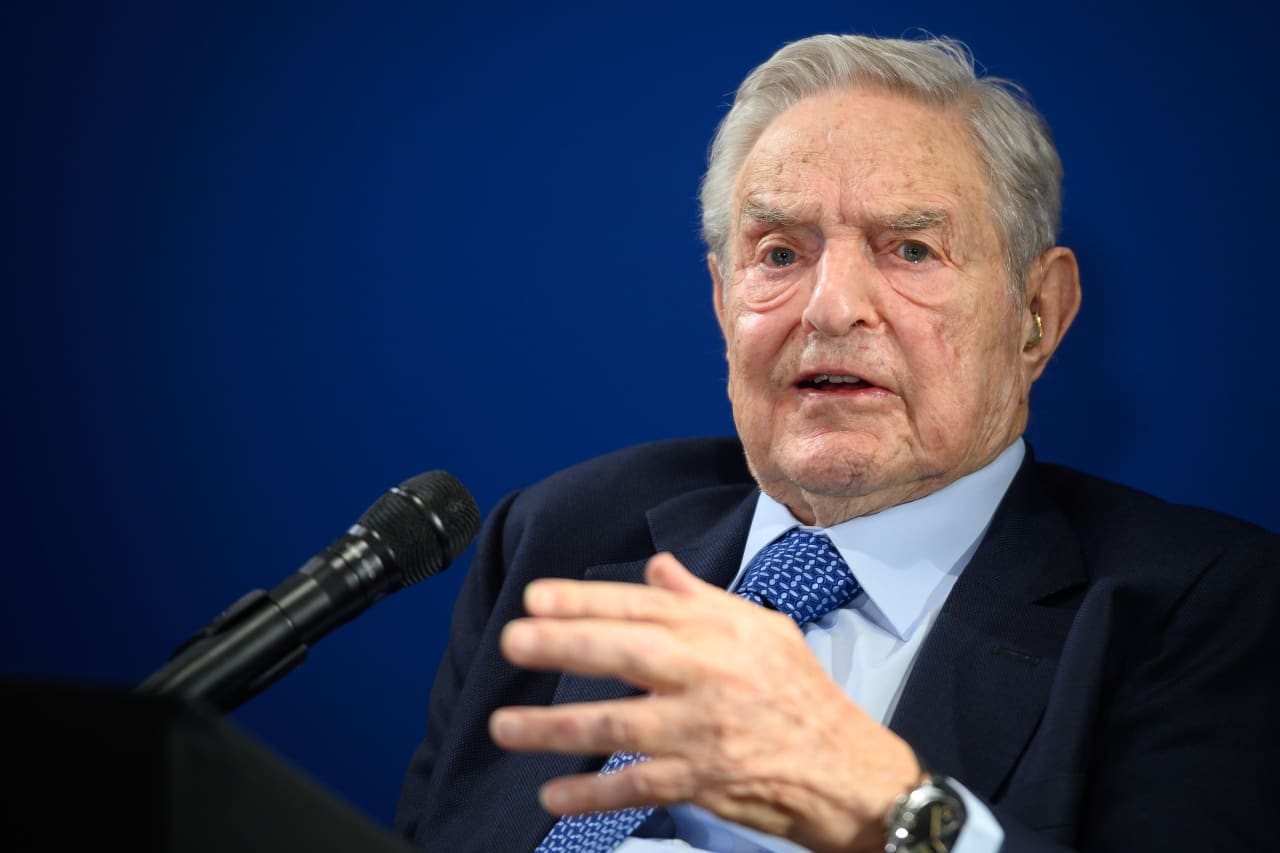

George Soros’ fund set to become largest shareholder in radio giant Audacy

Radio and podcasting giant Audacy Inc. has received court approval to emerge from bankruptcy, with George Soros’ investment fund on track to become the company’s largest stakeholder.

The U.S. Bankruptcy Court for the Southern District of Texas on Tuesday approved Audacy’s plan to emerge from the chapter 11 process, which the company filed for in January. Audacy said it plans to emerge from bankruptcy once the Federal Communications Commission gives its approval.

In a statement, Chief Executive David J. Field called the bankruptcy court’s approval “a powerful step forward” that will allow Audacy “to pursue our strategic goals and opportunities in the dynamic audio business.”

Under its prepackaged restructuring plan, Audacy will reduce about 80% of its $1.9 billion of debt, to roughly $350 million.

Last week, court filings disclosed that Soros Fund Management — the billionaire’s investment fund — had acquired about $415 million of Audacy’s first-lien debt. That means that Soros would be among the first creditors to be paid back, in the form of equity in the restructured company once it emerges from bankruptcy. That stake would make Soros’ investment fund Audacy’s largest shareholder, Bloomberg News reported last week.

Audacy picked up most of its debt after its merger with CBS Radio in 2017. It owns more than 200 radio stations across the U.S., including WFAN and WINS in New York, KROQ in Los Angeles and KCBS in San Francisco. In its bankruptcy filing, Audacy said it faced a “perfect storm of sustained macroeconomic challenges,” including a cratering advertising market.

Audacy shares

AUDAQ,

were delisted from the New York Stock Exchange in November, and are now traded over the counter. The stock has sunk 97% over the past 12 months, though it rallied 44% on Tuesday, to 20 cents, its highest level since early January.

Source link