For New Yorkers, ‘there are no consequences for not paying your property taxes’ as delinquencies spike to $880 million

More New Yorkers have stopped paying their property taxes — a troubling trend since the onset of the pandemic that city officials attribute to the end of a tax-lien sales program that punishes delinquency.

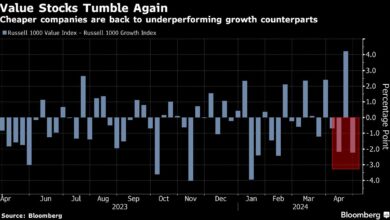

Overdue property taxes are forecast to reach its highest level ever, jumping by over 30% to more than $880 million at the end of the fiscal year in June from three years ago, according to an offering document for a city general obligation bond sale Tuesday. That means New York could be bringing in less tax revenue, since close to half of it comes from property tax collections.

“It’s not just the absolute dollar amount that I think should worry us all,” said Preston Niblack, the city’s Finance Commissioner at a March 4 City Council finance committee hearing.

It’s people realizing that “there are no consequences for not paying your property taxes,” he said. “That just can’t be allowed to continue.”

To be sure, the rise in unpaid property taxes comes as New York’s office market continues to struggle. The overall vacancy rate for Manhattan office space stood at 22.5% in November, the highest on record, according to the city’s January financial plan.

Rent-regulated apartments are also facing stress after a 2019 law sharply reduced landlords’ ability to raise rents.

Since a tax-lien sale program on unpaid property taxes expired in March 2022 and wasn’t reauthorized by City Council, officials say delinquent owners have no incentive to pay their debts. Under that plan, the city was authorized to sell liens on single-family homes and condos after three years of nonpayment, liens on other property types could be sold after one year.

The city would package its most marketable liens into securities for sale at a discount to a third-party trust, which borrows money from investors to pay the city upfront. The trust assumes responsibility for collecting the debt through servicers and add fees and interest payments. After investors are paid back, the city is entitled to collect additional revenue from interest payments and fees.

Community activists and some elected officials criticized the program for unduly targeting low-income property owners. The “additional fees can quickly turn a relatively small tax lien into an overwhelming financial burden, eventually pushing homeowners into foreclosure,” New York Attorney General Letitia James said in December 2020, referring to a mandatory 5% surcharge, legal fees and a 9% or 18% interest rate that compounds daily.

Equitable Solution

The city’s Department of Finance said it is working on legislation that would reauthorize tax-lien sales that would ensure homeowners don’t face foreclosure or eviction.

“We look forward to working with the [City] Council on this important issue and look forward to a new, more equitable form of property tax enforcement.” said Ryan Lavis, a Department of Finance spokesman.

The City Council said in a statement it is working with the “Administration, advocates, impacted communities, and all stakeholders to advance policies that address outstanding charges while supporting the economic health of homeowners, our communities, and the City.”

Former Mayor Rudolph Giuliani created tax-lien sales in 1996, in an effort to raise revenue and close budget gaps. Between fiscal years 2018 and 2022 the city collected $260 million from such sales, according to the city’s bond offering document — a fraction of revenue generated by overall property taxes.

New York expects to collect $32.7 billion in property taxes in the current fiscal year, providing about 45% of city tax revenue and almost 30% of overall funds for the current $114 billion budget.

City Council Member Gale Brewer, who represents the Upper West Side of Manhattan, said three buildings in her district each owe $1 million. As of March 8, single-family and condo owners made up a third of delinquencies while rentals comprised 28.5% and commercial property 38.2%, according to the Department of Finance.

The biggest scofflaws: A 16-unit Cobble Hill, Brooklyn, rental building owes $52.2 million and a 49-unit apartment building in the Bronx owes $24.7 million, according to a list compiled by the city’s Department of Finance for Bloomberg News.

Hyacinth Blanchard, listed by the city’s Department of Housing and Preservation as the head officer of the Cobble Hill property, didn’t return a voice mail requesting comment. No one answered the phone at Romad Realty, the listed owner of the apartment building in the Bronx.

“We have to do something,” Brewer said. “People should pay their taxes.”

Source link