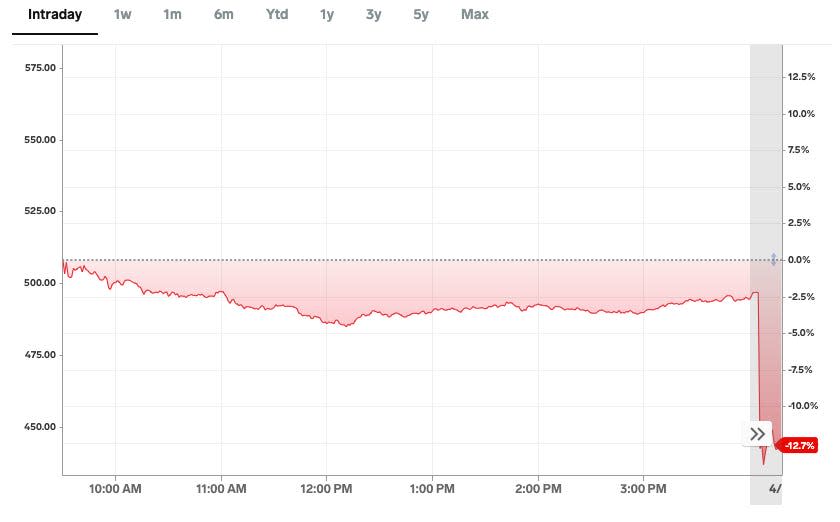

shares tumble 17% after hours despite beating estimates; stock down on weak revenue guidance

-

Meta reported first-quarter earnings on Wednesday.

-

Mark Zuckerberg talked about Meta’s plans to invest more in AI.

-

Shares tumbled 17% in after-hours trading.

Meta reported first-quarter earnings on Wednesday after the closing bell.

The company reported revenue and earnings-per-share that beat consensus analyst estimates. But shares slid after Meta gave a range for second-quarter sales that was on the light side of forecasts and said it’s going to spend more than it expected this year.

The report is Meta’s first without monthly- and daily-average-user numbers specifically broken out for Facebook. The company instead reported overall “Family of Apps” results that also included Instagram and WhatsApp. The combined group saw $36 billion of revenue, beating the consensus estimate of $35.5 billion.

Meta’s stock fell as much as 17% in after-hours trading, having slipped 0.5% on Wednesday. It had previously gained a robust 39% in 2024.

CEO Mark Zuckerberg’s main focus on the investor call was Meta’s plans to invest more significantly in AI. He also hyped up the company’s recent partnership with Ray-Ban.

Meta’s stock shows no sign of recovery as the Q&A ends.

Shares remain down nearly 17% in after-hours trading as the call draws to a close.

Meta CFO Susan Li is pretty tight-lipped about TikTok

Li says Meta has been following the potential for a TikTok ban closely, but it’s too soon to comment on how it could impact Meta’s business — for example, Instagram Reels.

The call moves on to the Q&A portion

Time for investors and analysts to (try to) get more details.

Zuckerberg appears to take a dig at Apple’s Vision Pro

Zuckerberg hypes up Meta’s Ray-Ban AI glasses. The company introduced new styles and features on Tuesday.

“You know, I used to think that AR glasses wouldn’t really be a mainstream product until we had full holographic displays. And I still think that that’s gonna be awesome and is the long-term mature state for the product. But now, it seems pretty clear that there’s also a meaningful market for fashionable AI glasses without a display,” he says.

It could be seen as a dig at Apple’s Vision Pro headset, which has been accused of being clunky and uncomfortable. Or it could just be another step forward in Zuck’s recent fashion journey.

Zuckerberg starts the call by getting straight into Meta’s AI plans and spending

He says the company plans to invest “significantly more” in AI, but warns it will take “several years” to build “the leading AI.”

“Realistically, even with shifting many of our existing resources to focus on AI, we will still grow our investment envelope meaningfully before we make much revenue from some of these new products,” he says.

The CEO says Meta has a “strong track record of monetizing” its work, especially after spending time building up its products over time. But that doesn’t seem to reassure investors right now, with shares slumping even further in postmarket trading.

The call kicks off.

Mark Zuckerberg and CFO Susan Li are here to discuss the results.

Meta’s AI plans are going to cost them more than they expected.

Heading into the call, investors were looking for news about Meta’s future AI plans, but — whatever they are — they’re going to cost way more than the company predicted just a few months ago.

“Our full-year 2024 capital expenditures will be in the range of $35-40 billion, increased from our prior range of $30-37 billion as we continue to accelerate our infrastructure investments to support our artificial intelligence (AI) roadmap,” the report says, noting Meta plans to “invest aggressively to support our ambitious AI research and product development efforts.”

Total expenses will be in the range of $96-99 billion, up from a prior $94-99 billion forecast due to higher infrastructure and legal costs.

Still, Max Willens, senior analyst at market research firm Emarketer, a sister company to Business Insider, says it’s not surprising Meta changed its guidance.

“Companies investing in this space, especially at the scope Meta is investing in it, may struggle with costs in the near term,” Willens says.

Meta stock falls 10% in after-hours training after light 2nd-quarter revenue forecast.

Meta beats 1st-quarter sales and EPS estimates, but issues weaker-than-expected 2nd-quarter guidance.

1st quarter

-

Revenue: $36.46 billion, +27% y/y, estimate $36.12 billion

-

Advertising revenue: $35.64 billion, +27% y/y, estimate $35.57 billion

-

Family of Apps revenue: $36.02 billion, +27% y/y, estimate $35.53 billion

-

Reality Labs revenue: $440 million, +30% y/y, estimate $494.1 million

-

Other revenue: $380 million, +85% y/y, estimate $300.1 million

-

-

Family of Apps operating income: $17.66 billion, +57% y/y, estimate $17.76 billion

-

Reality Labs operating loss: $3.85 billion, -3.7% y/y, estimate loss $4.51 billion

-

Operating margin: 38% vs. 25% y/y, estimate 37.2%

-

EPS: $4.71 vs. $2.20 y/y, estimate $4.30

-

Average Family service users per day: 3.24 billion, +7.3% y/y, estimate 3.16 billion

2nd quarter

Goldman Sachs says Meta’s platforms offer ‘sizable opportunity’ ahead.

Meta looks geared for strength as it’s a key beneficiary of a robust advertising environment, Goldman Sachs said.

The bank expects continued investment in digital channels, advertiser verticals to recover, and digital products to expand, such as short-form video monetization.

Meta’s Instagram Reels is a prime example of this, with the platform reaching revenue neutrality

“We still see a sizable opportunity for Reels to remain a key revenue growth tailwind for META in the coming years as the CPM gap closes further and as Reels continues to increase as a % of total ad impressions,” analysts led by Eric Sheridan said.

Goldman Sachs rates Meta at “Buy” and holds a 12-month price target of $555.

JPMorgan sees Meta as ‘built for the long term.’

JPMorgan considers Meta one of its top picks among internet stocks for its scale, growth, and profitability.

“We believe Meta’s virtual ownership of the social graph, strong competitive moat, and focus on the user experience position it to become an enduring blue-chip company built for the long term,” analysts led by Doug Anmuth wrote last week.

The bank expects Meta advertising to continue outperforming, bolstered by AI investments and Instagram Reels revenue expansions. Cost discipline will continue on through 2024, even if investments start rising.

Still, the bank did note some room for concern after this quarter’s earnings, as Meta may need to find new catalysts for further expansion.

“META remains well-owned, but there is growing caution into earnings on almost-certain growth deceleration beyond 1Q due to tough comps & perception of lack of new drivers vs. ’23. We believe slower growth is well-anticipated, & likely taken into account in META’s undemanding multiple,” the bank wrote.

JPMorgan rates Meta at “Overweight” with a $535 price target.

Wells Fargo says AI upside is accelerating Meta’s growth.

Meta is an accelerating growth story led by emerging AI upside, uplifting everything from the firm’s ad tools to consumer messaging products, Wells Fargo said.

The bank projects above-consensus revenue growth, with Meta boosted higher by a healthy e-commerce environment.

“Combined with a newfound appetite for efficiency, we believe META should be a steady earnings compounder at a reasonable multiple,” analysts led by Ken Gawrelski said.

However, revenue could moderate into the second-quarter, and Meta will have to demonstrate another product-cycle catalyst to keep momentum rolling, the bank wrote.

“We view WhatsApp as an under-appreciated asset w/ sizable potential, should Meta invoke more direct monetization beyond Click-to-Message ads,” Gawrelski wrote.

Wells Fargo rates Meta at “Overweight” with a $600 price target.

RBC Capital spotlights Meta’s growing lead in the ad business.

The Canadian bank touted a significant ramp up in ad volumes across Meta services, with Instagram Reels advertising taking center stage.

In fact, ad loads on Reels jumped 22% from January’s 16.4%, outpacing declining volumes among competitors such as TikTok.

“While slower growth out of Facebook is to be expected going forward, we believe few others in the space can come close to matching META’s scale for incremental spend, and we therefore expect META to at least maintain share going forward,” analysts led by Brad Erickson wrote last Thursday.

The bank also considers Meta to be trading at a discount to the broader internet segment, a gap that will persist or narrow based on whether the firm can demonstrate stability in the ad business.

However, some pullback could occur in the first half of the year given China’s economic slowdown, which could impact ad spending. Still, the firm offers other positives, analysts said.

RBC rates Meta at “Outperform” with a $600 price target.

Bank of America sees Meta’s AI assets as under-appreciated.

Bank of America expects to see upside in Meta’s first-quarter report, citing higher ad spending that was boosted by seasonal events, such as Easter.

Meanwhile, Meta’s AI assets remain under-appreciated, and the firm will benefit by highlight its growing capabilities in the space, the bank said in a note last week.

“We remain positive on Meta and reiterate our thesis that Reels, Messaging, and AI driven ad improvements are still early, and could lead to positive product surprises & revenue momentum in 2024,” analysts Justin Post and Nitin Bansal said.

Meta also looks to be the biggest winner amid a possible TikTok ban, which has now made its way through the Senate.

Bank of America rates Meta at “Buy” with a $550 price target.

Meta’s consensus first-quarter revenue estimate is $36.12 billion.

1st quarter

-

Revenue estimate: $36.12 billion

-

Advertising rev. estimate: $35.57 billion

-

Family of Apps revenue estimate: $35.52 billion

-

Reality Labs revenue estimate: $494.1 million

-

Other revenue estimate: $286.4 million

-

-

Adjusted operating income estimate: $13.45 billion

-

Operating margin estimate: 37.2%

-

EPS estimate: $4.30

-

Facebook daily active users estimate: 2.11 billion

-

Facebook monthly active users estimate: 3.08 billion

-

Ad impressions estimate: +17.1%

-

Average Family service users per day estimate: 3.16 billion

-

Average Family service users per month estimate: 3.97 billion

2nd quarter

Full-year 2024

Read the original article on Business Insider

Source link