Nvidia Surges After Company Proclaims AI Has Hit ‘Tipping Point’

(Bloomberg) — A rally in global stocks is set to extend to Europe after Nvidia’s blowout sales forecast reaffirmed investor conviction in technology and semiconductor companies amid a boom in generative AI use.

Most Read from Bloomberg

Europe’s Stoxx 50 futures climbed nearly 0.9%, tracking a similar rally in Asian stocks and US equity futures contracts. Japanese stocks rallied, with the Nikkei 225 Index closing at a record high last achieved in 1989, driven by gains in technology shares and chip-gear producers.

“After some recent consolidation, Nvidia’s earnings beat is just the perfect catalyst for Japanese equities to reach record highs,” said Charu Chanana, strategist at Saxo Capital Markets. “Structural tailwinds from geopolitics to corporate reform, as well as a weak yen, continue to suggest that Japanese equities is a story where macro meets momentum and a peak is still rather far,” she said.

Stocks also rose in South Korea, Taiwan and China, with a gauge of Asian shares rising to its highest level in almost two years.

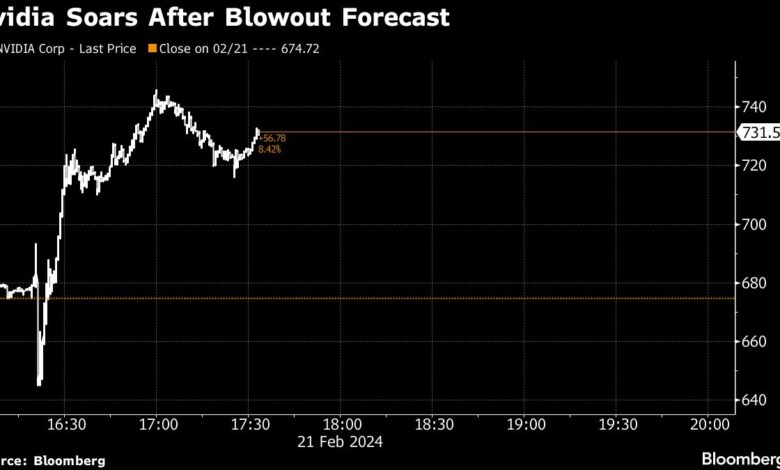

US stock futures jumped in Asian trading after Nvidia’s results. The tech company’s shares soared as much as 11% in post-market trade after it said first-quarter revenue would likely hit $24 billion, above prior estimates of around $22 billion.

The results were expected to provide a catalyst for global equities, and delivered on the promise. Nvidia’s Asia-based suppliers SK Hynix Inc jumped to its 24-year high, while Advantest Corp hit a record.

“As goes Nvidia, so goes the market,” said Kim Forrest, chief investment officer of Bokeh Capital Partners LLC. “And it looks like the results are good enough. It does confirm the narrative that AI is going to continue to be strong for the foreseeable future. This narrative supported the markets last year, why wouldn’t it do the same this year?”

Shares in mainland China are heading for their longest stretch of gains since 2020 after the raft of recent measures undertaken by authorities to stabilize the market and prop up investor sentiment. The CSI 300 and Hang Seng Index climbed as the securities regulator tightened its grip on the market following an order banning major institutional investors from reducing equity holdings at the open and close of each trading day, according to people familiar with the matter.

“We think government will continue its supportive policies, which has a positive spillover for Asia,” Yifan Hu, regional CIO and head of Asia Pacific macroeconomic at UBS Wealth Management told Bloomberg television. “For Asia, GDP growth will be better than last year compared to the rest of the world.”

Asian investors rediscovered their optimism, seen toward the end of 2023, as they look set to overcome January’s losses this month, boosted by recovery in China and gains in Japan. Expectations of improvement in technology earnings led by chipmakers in the region has also added to the appeal of the continent’s stocks.

The dollar slipped against Group-of-10 currencies. The yen was largely unchanged at around 150 per dollar, while the won pared its gains after comments from Bank of Korea’s Governor Rhee Chang-yong following the central bank’s decision to leave key interest rate unchanged.

Treasuries were steady in Asia trading after a sell off Wednesday pushing the 10-year yield five basis points higher. The selling pressure was seen across the curve, and followed a $16 billion sale of 20-year bonds and the release of Federal Reserve meeting minutes that revealed caution about cutting rates.

Richmond Fed chief Thomas Barkin highlighted persistent pricing pressures in sectors such as housing even though headline inflation is falling. Fed Governor Michelle Bowman, meanwhile, pushed back against the prospect of imminent cuts.

Later Thursday economic data set for release includes Eurozone inflation and PMIs, as well as US initial jobless claims and home sales.

Elsewhere, Nestle SA forecast a slowdown in revenue growth as easing inflation will see it ease off on price increases to boost consumption, while Mercedes-Benz Group AG said it expects returns to decline this year on slowing global economy.

West Texas Intermediate crude added to a 1.1% gain on Wednesday and climbed above $78 per barrel mark, supported by tightening physical supplies. Gold climbed above $2,029 per ounce. Bitcoin steadied after a drop Wednesday.

Key Events This Week:

-

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, CPI, Thursday

-

US initial jobless claims, US existing home sales, Thursday

-

ECB issues account of January meeting, Thursday

-

Fed Governor Lisa Cook and Minneapolis Fed President Neel Kashkari speak, Thursday

-

China property prices, Friday

-

Germany IFO business climate, GDP, Friday

-

ECB publishes 1- and 3-Year inflation expectations survey, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.8% as of 3:22 p.m. Tokyo time

-

Nasdaq 100 futures rose 1.5%

-

S&P/ASX 200 futures were little changed

-

Hong Kong’s Hang Seng rose 0.7%

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures rose 0.8%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1%

-

The euro rose 0.2% to $1.0837

-

The Japanese yen was little changed at 150.24 per dollar

-

The offshore yuan was little changed at 7.1980 per dollar

Cryptocurrencies

-

Bitcoin rose 0.4% to $51,578.65

-

Ether rose 0.3% to $2,935.21

Bonds

Commodities

-

West Texas Intermediate crude rose 0.3% to $78.18 a barrel

-

Spot gold rose 0.2% to $2,029.92 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link