Here’s Why That Makes the Stock a Buy

Tobacco company Altria Group (NYSE: MO) has long owned a 10% stake in Anheuser-Busch InBev, the world’s largest beer company. That stake is worth approximately $12 billion today. Recently, Altria announced it was selling up to 40 million of the 197 million shares it holds.

What does this mean for shareholders? I’ll give you a hint: Investors should be celebrating this news because they’re about to see more cash coming from Altria.

Here are all the reasons to love Altria’s decision and why the stock is a buy on this news.

1. Altria is significantly boosting share repurchases

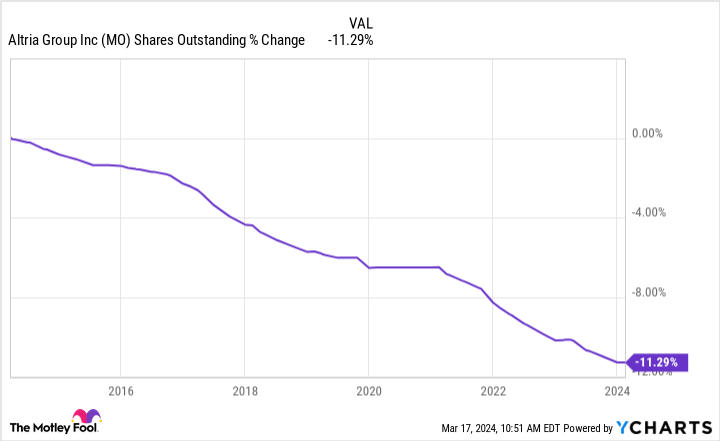

Most people know smoking cigarettes is a dwindling habit in the U.S. where Altria conducts virtually all its business. Yet, smokeable products make up the vast majority of revenue and profits. Altria has managed to offset its volume declines with price increases while using profits to repurchase shares and sustain earnings growth over the years. Altria’s share count has declined 11% over the past decade.

Altria is selling these 35 million shares to raise money for more aggressive repurchases. Management has already announced that it expects $2.4 billion in sale proceeds and is dedicating it all to buying back shares on top of the company’s existing $1 billion repurchase program. This has multiple benefits for shareholders.

2. Fewer shares help support the dividend

First, it means Altria owes a dividend on fewer shares. The stock yields a whopping 8.8% as of this writing. Retiring shares reduces the dividend obligation in terms of absolute dollars. Cash going toward stock buybacks essentially returns 8.8% at a minimum because Altria no longer pays the dividend on those shares.

This will also help Altria keep growing its dividend over time. The company could maintain its total dividend payout, and the per-share dividend would still increase due to fewer outstanding shares. Management said in a recent press release, “We remain committed to our progressive dividend goal that targets mid-single digits dividend per share growth annually through 2028.”

3. It signals that management believes the stock is cheap

Why did management do this? Why now?

It’s notable because Altria has held its Anheuser-Busch InBev stake for decades. It could be that management feels Altria stock is cheap enough right now to warrant a more aggressive buyback program. After all, the stock trades at a forward price-to-earnings of just 8.8, which is attractive for a business still growing earnings at a mid-single-digit pace.

It’s also important to note management only sold a small piece of its stake. The approximately 40 million shares represent 20% of Altria’s total holdings, and the company agreed to a 180-day lockup, preventing additional sales for the next six months.

Altria stock is a buy today

Altria is a potentially high-floor investment that could be a dividend stalwart for years. Investors get an 8.8% starting yield, roughly equal to the S&P 500‘s annual historical return. That means the stock has to deliver very little in actual price appreciation to beat the market.

The stock’s already low valuation means investors aren’t likely to see its earnings multiple shrink further. As a result, investors could capture any earnings growth as price appreciation. So if Altria continues to grow earnings at a mid-single-digit pace, that combines with the rich dividend for total investment returns in the low-teens range.

It’s a simple formula, but sometimes simple is best.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 18, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Altria Is Cashing in Part of Its $12.7 Billion Chip: Here’s Why That Makes the Stock a Buy was originally published by The Motley Fool

Source link