IBM stock nears an all-time high—and it may have something to do with its CEO replacing as many workers with AI as possible

IBM’s repositioning around AI may be paying off for its stock as it nears an all-time high amid its CEO’s ambitious plans for the technology.

The company’s shares have skyrocketed 19% since the start of the year and closed at $193.96 on Wednesday, just 6% off of its all-time high of $206.31 from 2013. Year-to-date, shares of the technology company have outpaced all of the Magnificent Seven companies, excluding red hot chipmaker Nvidia and social media giant Meta.

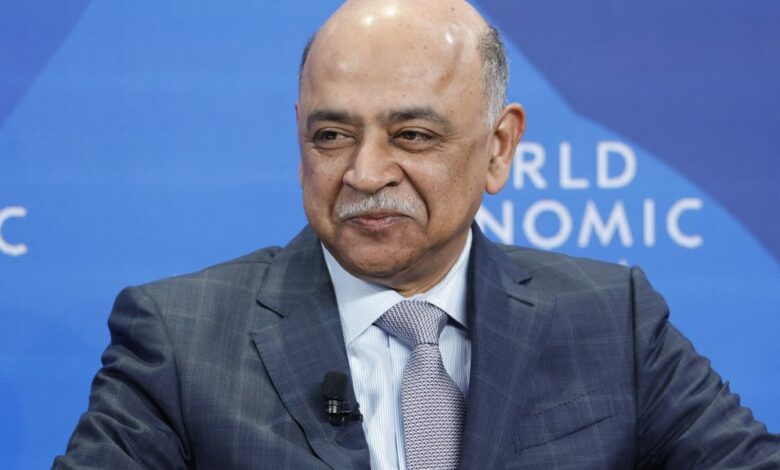

In an interview last year, IBM chief executive Arvind Krishna said he could see thousands of employees in “back-office” roles like human resources replaced by AI. Although he later backtracked, saying AI will create more jobs than it replaces, he again emphasized that “back office, white-collar work,” will be the first to be affected.

His own company used AI to reduce the number of employees working on relatively manual HR-related work to about 50 from 700 previously, which allowed them to focus on other things, he wrote in an April commentary piece for Fortune. And in its January fourth quarter earnings, the company said it would cut costs in 2024 by $3 billion, up from $2 billion previously, in part by laying off thousands of workers—some of which it later chalked up to AI influence.

“This rebalancing is driven by increases in productivity and our continued push to align our workforce with the skills most in demand among our clients, especially areas such as AI and hybrid cloud,” an IBM spokesperson told The Register in February.

Reminiscent of the late ‘90s, investors have clamored to cram money into nearly any company with AI involvement (so much so that the SEC has cracked down on so-called “AI washing”). So far in 2023, this trend has led to surges in the shares for Google, which has its own AI chatbot, and Microsoft, which has a profit-sharing deal with AI leader OpenAI.

But while those companies have attracted the most buzz around their AI capabilities, IBM has been bulking up its own AI products and quietly outperforming Google and Microsoft in the public market.

The 112-year-old tech company has been researching and developing its own artificial intelligence technology since the 1950s and garnered significant attention when its supercomputer Watson beat Jeopardy! champion Ken Jennings on live television in 2011. But despite its head start, IBM’s AI efforts have been outshined by OpenAI, which sparked the current AI mania when it released its chatbot ChatGPT in late 2022.

Still, through changes spearheaded by CEO Krishna, who ascended to the top job in 2020, IBM has worked to capitalize on its long-standing efforts by repositioning its business around the cloud and AI. In May, the company launched Watsonx, a platform for developing internal AI models aimed at enterprise customers. It has also dedicated more than 1,000 consultants to help customers like Spanish Bank BBVA and German software company SAP SE develop the models using their own data. Internally at IBM, three-quarters of its chip design is already done by AI, Krishna has said previously.

The company may already be gaining traction for its AI efforts. During its fourth quarter earnings call in January, Krishna said IBM’s book of business had doubled from where it stood as of the third quarter, when it was in the “low hundreds of millions.” Analysts at Morgan Stanley peg the value of its book of business at about $400 million.

“Our approach to AI for business is resonating,” added Krishna in his prepared remarks.

Morgan Stanley analysts led by Erik Woodring said in a January note that if IBM’s AI operations emulate the payoff of its other big bet, its 2019 Red Hat acquisition, the business could be worth multiple billions in just four years.

Still, the analysts cautioned that there are obstacles hampering IBM’s momentum.

“[T]he question is whether this AI spending is entirely incremental, or cannibalistic of other areas customers spend with IBM,” the analysts wrote.

Source link