Where Will Super Micro Computer Stock Be in 3 Years?

Super Micro Computer (NASDAQ: SMCI) stock has crushed the broader market in the past three years, with eye-popping gains of almost 2,990%, outpacing the tech-heavy Nasdaq-100 Technology Sector index’s return of just 22% by a huge margin.

You may be wondering if it is worth buying Supermicro, as it is commonly known, shares now following their stunning surge. The good news is that the stock for this producer of high-performance and high-efficiency computer servers trades at less than 5 times sales as of this writing, which makes buying the stock a no-brainer given the pace at which it is growing right now.

In this article, we’ll take a closer look at the catalysts that could send Supermicro soaring over the next three years and also check how much potential upside this stock could deliver.

Supermicro Computer’s growth is set to accelerate significantly

Supermicro manufactures modular high-performance server and storage solutions. The demand for the company’s offerings has been solid over the past three years. This is evident from the fact that Supermicro finished its fiscal 2023 (which ended on June 30, 2023) with $7.1 billion in revenue. That was a nice jump over the company’s fiscal 2020 revenue of $3.34 billion.

That translates into a solid three-year compound annual growth rate (CAGR) of 28%, allowing the company to almost double its top line during this period. However, Supermicro’s fiscal 2024 (which will end in June this year) revenue estimate of $14.5 billion shows it expects that its top line will more than double in the space of just a year.

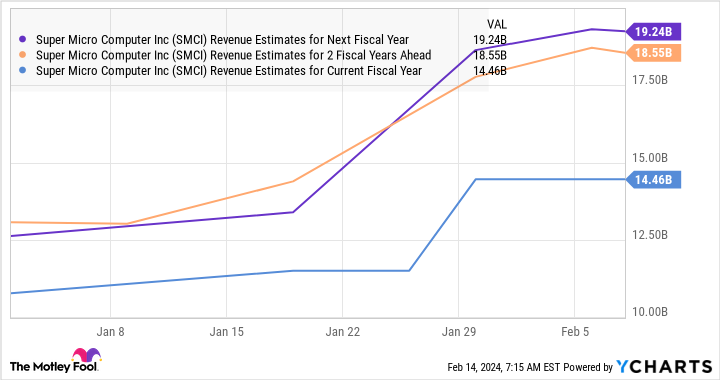

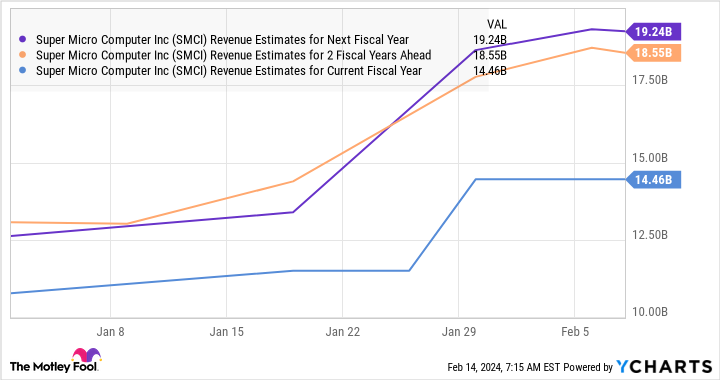

Even better, analysts have also raised their forecasts for the next couple of fiscal years.

According to the chart above, Supermicro’s top line could jump to more than $19 billion in fiscal 2026. If that’s indeed the case, Supermicro’s revenue CAGR will accelerate to more than 39% during fiscal 2024 to fiscal 2026. However, there is a good chance that the company could outpace analysts’ expectations and end fiscal 2026 with a higher top-line figure.

That’s because Supermicro is significantly upgrading its server production capacity and expects to increase its annual revenue potential to more than $25 billion very soon. Additionally, the company is witnessing an acceleration in the production utilization rate — which stood at 65% last quarter — at its existing factories in the U.S., Taiwan, and the Netherlands as well.

Supermicro says that its existing capacity is filling up quickly, and it won’t be surprising to see the same happen with the new capacity that the company brings online, because demand for its servers has taken off amid the artificial intelligence (AI) craze.

This is evident from the fact that Supermicro was originally anticipating fiscal 2024 revenue to land at $10 billion. But the surge in orders for its server racks that are used for deploying high-end AI chips from the likes of Nvidia has led it to increase its full-year guidance by a whopping 45% at the midpoint.

What’s more, the rosy prospects of the AI server market indicate that Supermicro could indeed hit $25 billion in revenue once it scales up its capacity. That’s because the global AI server market is expected to grow 5x between 2023 and 2027, generating annual revenue of $150 billion after three years. As a result, don’t be surprised to see Supermicro’s top-line growth continuing beyond fiscal 2026.

How much upside can investors expect over the next three years?

Assuming Supermicro’s top line increases to $25 billion in fiscal 2027 thanks to its improved production capacity and the robust demand for AI servers and the company maintains its current sales multiple of 5 at that time, its market cap could increase to $125 billion. That would be a big jump from the current market cap of around $45 billion, indicating that Supermicro stock could deliver healthy gains of almost 180% over the next three years.

So investors who haven’t bought this AI stock yet can consider doing so right away in light of the potential upside on offer over the next three years, as well as the fact that they can buy Supermicro at an attractive valuation presently despite its impressive surge.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

Where Will Super Micro Computer Stock Be in 3 Years? was originally published by The Motley Fool

Source link