Opinion: Biden gets the blame for inflation staying higher for longer, but he shouldn’t

U.S. inflation has come down, but not enough for voters to stop complaining about high prices.

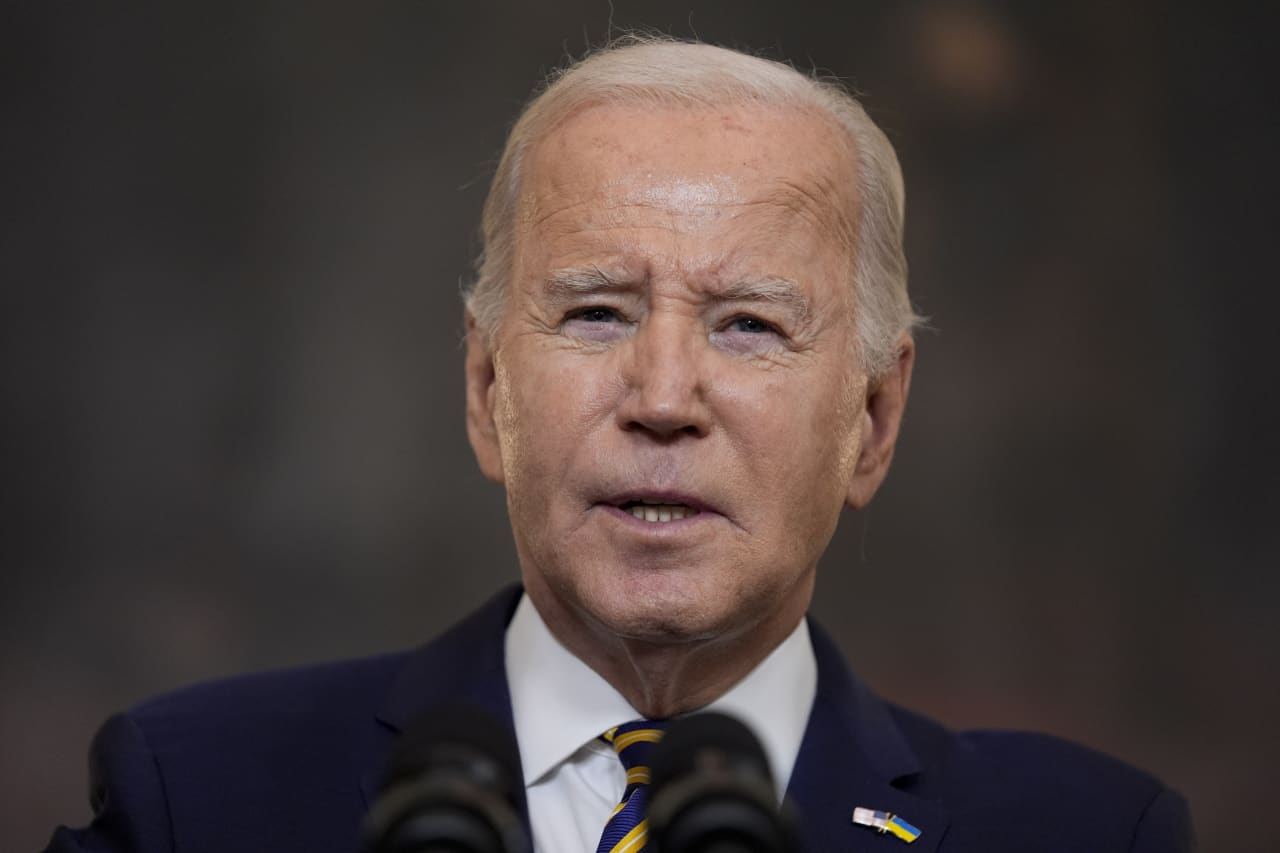

Since U.S. President Joe Biden took office, the economy has recovered from the COVID-19 pandemic shutdowns and is now advancing, just as economists expected in 2019 before the pandemic was on the horizon.

The rub is that prices have jumped 18% on Biden’s watch, and inflation continues well above 2% a year. During former President Donald Trump’s first three years in office, U.S. inflation was about 2%.

On inflation, Biden gets all the blame. That’s unreasonable, and reflects many people’s unwillingness to appreciate how markets work and prices are determined.

During the pandemic and early recovery, domestic and global supply chains broke down — recall shortages of computer chips and West Coast ports backing up. Ultimately, lockdowns in China curtailed imports of components and finished manufactures.

With more Americans working from home and many service establishments closed, consumers spent more heavily on some goods than services, stressing limited supplies.

Studies at the U.S. Federal Reserve indicate about half of the runup in prices could be attributed to supply constraints, which the Biden administration had little role in creating.

The U.S. government poured about $4.6 trillion into unemployment benefits, aid to states and local governments and other stimulus spending. This was enabled by the Fed expanding its balance sheet to monetize much of the resulting new federal debt.

The Fed printed money, but the inflation economists would expect didn’t happen right away for good reasons. First, money must get out into the markets for goods and services to have an impact. But other than buying more electronics and primping up home offices and family rooms, Americans hardly spent all their pandemic-relief checks.

Household savings surged above trend by about $2.1 trillion and did not start to fall significantly until late 2021 and decline rapidly before early 2022. Similarly, state and local governments couldn’t spend the COVID aid as fast as it arrived.

All the savings suggests that the aid the Trump administration distributed was far in excess of what was needed to keep households, small businesses and state and local governments afloat during the shutdown.

Second, the classical quantity theory of money requires full employment for more money to create higher prices with certainty. U.S. unemployment surged from 3.5% in February 2020 to 14.8% two months later, and did not return to pre-COVID levels until March 2022.

In the spring of 2022, two forces converged — pandemic money was finally being spent in earnest and labor markets returned to full employment. The delayed price effects of printing money showed up in April 2022. With the Fed denying culpability and arguing that higher prices were transitory, inflation accelerated to 9.1% in June 2022.

If responsibility is to be assigned, consider that Fed Chair Jerome Powell delayed action at the Fed, Trump administered most of the $4.6 trillion in stimulus, and Biden was warned that the final tranche of $1.9 trillion was irresponsible.

Of the three, Biden is the incumbent, running for reelection. Recent polls tracked by RealClearPolitics indicate 24% more voters disapprove of Biden’s handling of inflation than approve. Even if the pace of inflation has slowed, it is nagging, and human nature is not the friend of a sitting president at a time like this.

Grocery prices continue to rise but gasoline prices have fallen a lot since May. You’d think Biden would get some credit for that, but it’s human nature to focus on bad news and ignore the good. We are wired to respond more quickly to threats.

No surprise then, despite robust U.S. growth, low unemployment and inflation coming down, 57% of voters disapprove of Biden’s handling of the economy. Yet Trump likes big deficits too. Had Trump been reelected in 2020, he likely would have also spent too much, and on inflation I doubt Americans would be much better off.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.

More: True inflation may have peaked in late 2022 — at 18% — and still hovers around 8%

Source link