Mark Zuckerberg: Jensen Huang is the ‘Taylor Swift’ of tech

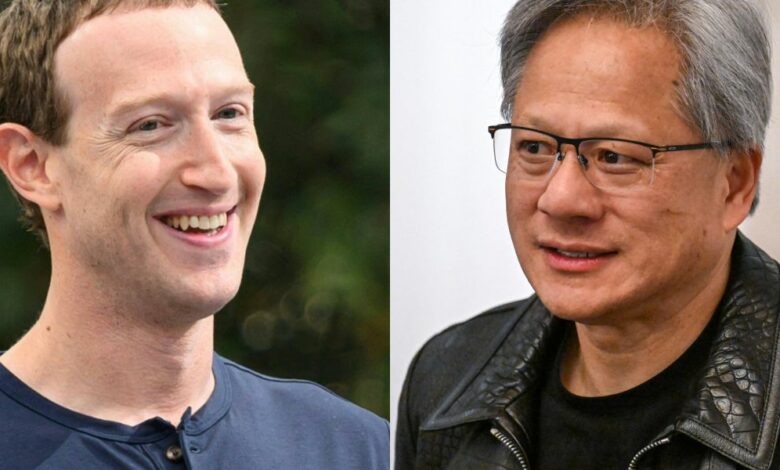

Meta CEO Mark Zuckerberg and Nvidia boss Jensen Huang have given the tech world the crossover no one knew they needed, complete with wardrobe swaps and gushing compliments.

But their collaboration goes deeper than an Instagram shot—their relationship is a pillar holding up the S&P500.

Facebook founder Zuckerberg posted a photo with chip titan Huang captioned ‘Jersey swap’ on Instagram—a social media app he also owns.

The photo showed Zuckerberg wearing Huang’s signature black leather jacket, while Huang donned Zuckerberg’s brown-and-cream shearling coat.

With Zuckerberg’s net wealth of $175 billion and Huang’s $79.5 billion, the post quickly caught the imagination of followers and gained more than 151,000 likes within 24 hours of posting.

While fans flooded to comment on the pair’s outfits, the fanboying didn’t stop there.

Replying to one fan who was unfamiliar with Huang’s identity, dad-of-three Zuckerberg replied: “He’s like Taylor Swift, but for tech.”

The ‘Taylor Swift of tech’

Swift has dominated the news over the past year courtesy of her ‘Eras Tour,’ which saw the ‘Love Story’ singer become a billionaire while generating so much economic activity that Wall Street began penning notes on her activity.

Huang has had a similarly stratospheric start to 2024.

So far the chipmaker’s stock is up nearly 90% for the year to date with Wall Street remaining generally bullish on the continuing outlook.

Zuckerberg also hinted this won’t be the last unexpected fashion interaction between the pair.

Replying to another comment, Harvard dropout Zuckerberg said: “I did get Jensen a black shearling coat for his collection that I’ll give to him next time I see him.”

The comment section on ‘Zuck’s’ Instagram page also gave a tongue-in-cheek insight into what the pair might have discussed.

One user questioned whether the meet was Meta buying H100 chips—which Zuckerberg said in January he was stockpiling to a level of 340,000 by the end of the year.

But Zuckerberg responded: “Planning for those B100s.”

Nvidia’s ‘Blackwell’ B100 is an AI chip already being used by Amazon Web Services.

Why the Zuckerberg-Huang link-up matters

The relationship between Meta and Nvidia is mutually beneficial.

For starters, Meta is widely reported as being one of Nvidia’s biggest customers.

In January, Zuckerberg indicated he was spending billions of dollars a year on H100 chips, saying his company was building a “massive compute infrastructure.”

In an Instagram reels post, he added this will include 350,000 of the Nvidia graphics cards.

On eBay, these chips sell for anywhere up to $48,000, while analysts told CNBC they expect the business is directly selling at $25,000 to $30,000.

Huang has also been outspoken about Meta’s input into the AI race.

Speaking at the World Governments Summit in Dubai earlier this year, Huang said: “Let’s face it, the single most important thing that has happened last year—if you were to ask me—the one, single, most important event last year and how it has activated AI researchers here in this region is actually Llama 2.”

Llama 2 is Meta’s open source large language model, which is available for free for both research and commercial use.

And while Huang has signposted Meta’s contribution to the sector, Zuckerberg’s confidence in a supply of chips—a concern for many tech businesses—will also allow him to deliver on the AI promises that have boosted Wall Street’s confidence in the business.

Zuckerberg’s wealth has soared since he took a step back from his metaverse dream to focus on AI technology.

For Meta’s largest individual shareholder, a combination of a 2023 “year of efficiency” and making AI the company’s priority resulted in a near–$40 billion boost last year.

Indeed, in February the term “AI” was used more than 80 times by Meta staffers on the call—a move that has proved something of a surefire way to pique the interest of investors.

Courtesy of the positive picture Zuckerberg and his team had for analysts—and the clear show of focus on the emerging technology—Meta’s share price shot up 20% in the hours following the announcement.

The support between the pair comes at the very top of the stock market: the couple are two of the ‘Magnificent 7’ stocks, the Herculean shares that have held up the S&P500 in recent years.

This smooth relationship between the two has contributed to confidence among investors and share price gains for both—Meta is up 42% in the year to date—meaning the multi-billion dollar bromance may go far deeper than outwear.