A taxpayer bailout for banks caught up in office carnage? Unlikely, analyst says.

A federal bailout for banks swept up by carnage in the office sector looks unlikely, even if the situation continues to worsen, according to Oxford Economics.

Bank stress appears to be “far from over” four years since the pandemic struck, especially with today’s high office vacancies and a wave of debt coming due this year, said Ryan Sweet, chief U.S. economist at Oxford Economics, in a Monday client note.

However, Sweet sees fallout “for now, to be manageable,” making a bailout for banks mired in hard-hit commercial real estate unlikely.

“In other words, the federal government, and ultimately the taxpayer, is not going to be riding in to save the day unless the deterioration in office poses a systemic risk to the financial system or the broader economy,” Sweet wrote.

Sweet’s team focused mostly on the ravaged office sector, where they estimate prices have fallen about 28.6% below their 2019 peak levels.

Gauging property values has been difficult since the Federal Reserve began raising interest rates in 2022, because it put a freeze on transaction volumes. The closely followed Green Street Commercial Property Price Index, for example, estimated office prices in January were 35% below their most recent peak.

Older office buildings in the hearts of big cities have seen prices fall the most, while rents in a select cluster of new, trophy buildings have kept climbing.

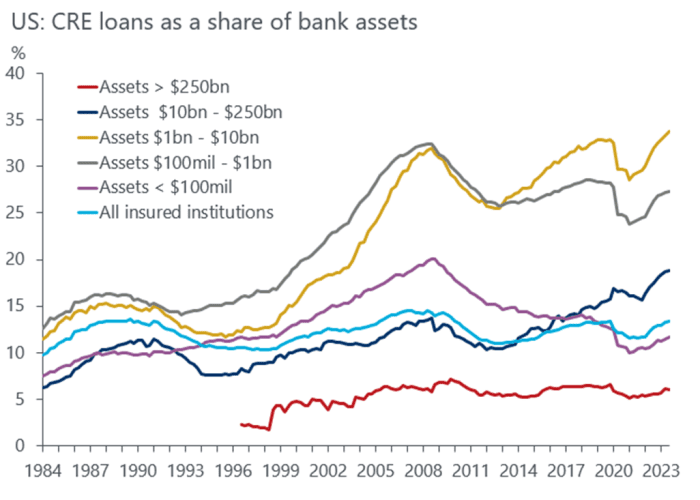

Still, smaller banks, with $1 billion to $10 billion in assets, appear to be the most vulnerable to falling commercial real-estate values. Around 35% of their assets are tethered to the sector, more than double since the 1980s.

Smaller banks have more than doubled their exposure to commercial real-estate loans since the 1980s, making them particularly vulnerable to falling commercial real-estate values.

Oxford Economics

New York Community Bancorp Inc.

NYCB,

reignited worries about commercial real estate and regional banks in late January after it reported a loss on two commercial property loans.

Federal Reserve officials in recent weeks also have pushed back on the timing of expected rate cuts this year, raising risks of distress among landlords with debt coming due.

As an offset, Sweet’s team estimates that less than 5% of regional bank commercial real-estate loans are tied to office buildings, while it’s closer to 1% to 2% for larger banks.

If the damage remains mostly limited to office buildings, Sweet sees a drawn-out road to recovery for lenders, akin to the savings-and-loan crisis of the 1980s.

“The key is how this continues to unfold, as a slow burn similar to the S&L experience or something worse,” Sweet said.

Source link